It is quite well known that majority of general accounting work pattern involve transactional and repetitive on day, month and year bases. Every month, the same entries are prepared and same procedures required to apply. Here, the procedures remain same, perhaps the numbers might vary. Hence, conventional accountants are quite comfortable with structure and routine.

While the status quo has been maintained so far, with the developmental surge in technology such as use of automation along with Artificial Intelligence(AI) and machine learning processes there are upcoming huge changes. It appears that technology, apart from its benefit, can disrupt the future of accountants in job market in ways we can’t even predict.

The Threat

The website tool developed by Deloitte and Oxford University, perhaps depict the most permissive view of the future of accounting jobs. It indicates that accountants have a 95% chance of loosing their jobs to robots.

More precisely, a study by the Brooking Institute, have the prediction that accounting jobs having a higher percentage of repetitive tasks may be at a higher risk of replacement by automation. Moreover, the study further indicated that tremendous advancements in AI may make better paid accountants doing such repetitive tasks more vulnerable to replacement.

Since one can’t stop the entry of new technologies, at the same time, one can’t allow the job of accountants to become endangered towards extinction. Let’s have a look on the impact of technology on the job of an accountant and how to get rid of that scenario.

1. Basic Automation

Introduction of automated accounting work flow over the classical double entry book keeping and insertion of Quick Books in early 1990s, reduced the work and time in data entry. Automations helped to streamline processes regarding conversion of human error-prone exhaustive processes into error free efficient processes having little human intervention.

2. Introduction of Application Programming Interface(API)

Development of API made accounting processes much easier due to its capability of interacting with different software’s in the accounting system. API thus, replace coding for connecting two systems rather created a quick automated accounting work flow.

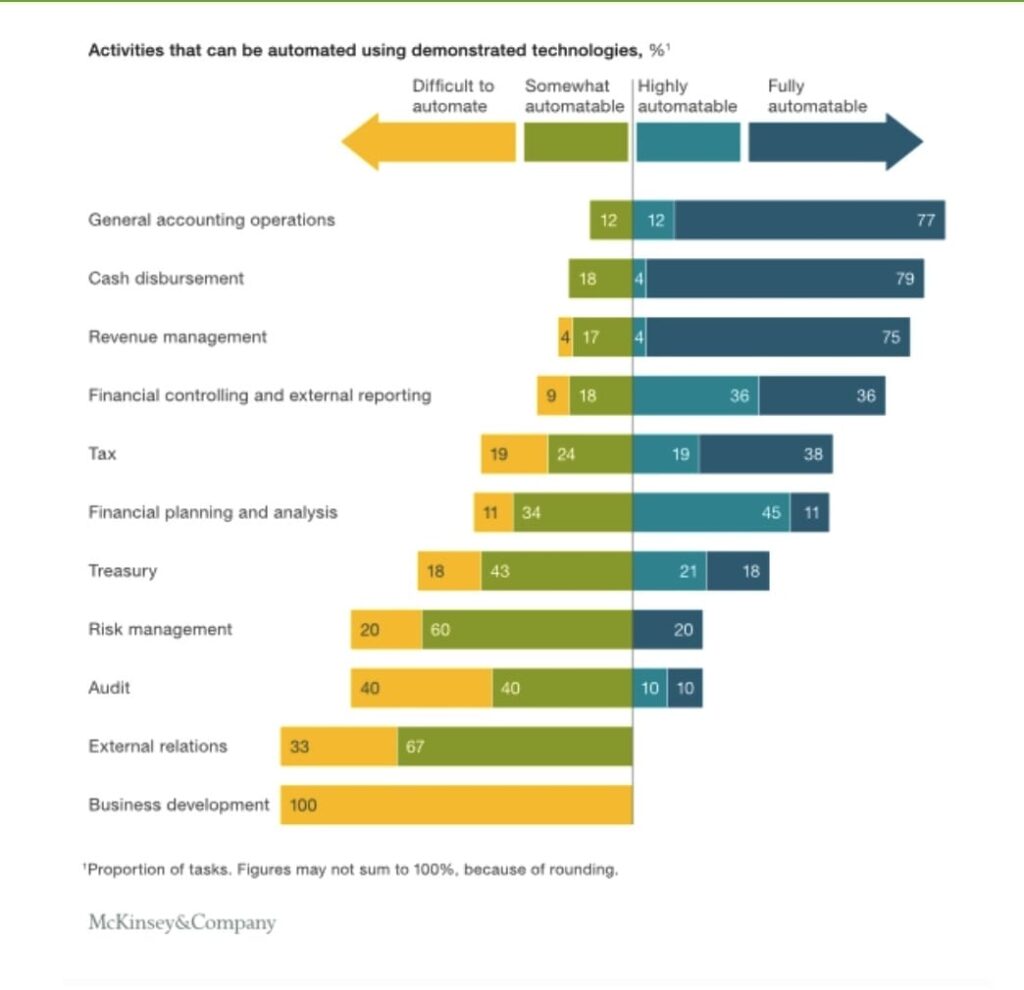

APIs also being applied in bank feeds so that transaction from accounts/cards can be directly downloaded in to the accounting system. The graphical representation from McKinsey(Figure below), shows the different accounting tasks that can be replaced by automation.

3. Robotic Process Automation(RPA)

RPA is a rule based program such as the Order to Cash software for example. It can collect order from customer portal enroute to to the specific site for fulfillment of the order and followed by making invoices and collection of payment at one go, thus, reducing the man power.

4. AI and Machine Learning

The AI and Machine Learning is expanding now a days expanding their functionality over the programmed rules. They provide access to a larger database of accounting transactions. By detecting the inherent data pattern, they help to improve the decision making avoiding human errors- a replacement for manual repetitive tasks.

5. Replacement of Accountants by Robots?

Though it is still far away, but possibility exist particularly for the accountants associated with low value repetitive works. It is apparent that automation is ideal for the kinds of exhaustive, drudging repetitive tasks where a classified accountant is no longer required.

6. The Way In is Way Out

The measures to be taken to prevent the threat of extinction, an accountant has to convert the low value work to a high value work pattern. This means amalgation of advancing technologies and the upgraded professional accounting knowledge.

Combining accounting information with data from various segments of the business and simultaneous application of data analytics help to unravel the hidden patterns unseen by human eyes. This is the kind of high value work associated with decision making processes and providing foresight for shifting the business strategy. Due to this, today’s business leaders are more akin to hire such accountants accustomed to such kind of work having actionable insights.

According to study by Grant Thornton(2020 survey of CFOs), about 90% of finance functions are going to be fully automated within 5 years. This is highly suggestive that to cope with the changing parameters, accountants are required to upgrade their professional skills, knowledge and should learn to use different tools.

To rule out the notion that accounting is going to be a dying profession one can take help by pursuing the following courses at their respective capacity.

6.1 US CMA Course

US CMA course is an internationally recognized professional accounting course in the management accounting and strategic financial management. This certification imparts knowledge of financial planning, analysis, control, decision support etc.

Plan for US CMA course in 2022- Jobs & Salary |Eligibility| Course fees |Syllabus| Duration | :- Earning the US CMA can give you the career boost as they have an excellent rate of absorption all over the world. Currently, US CMA has marked its presence in over 100 countries including the United States (US)…...continue reading…

6.2 US CPA Course

CPA US course is another high value top most accounting qualification in global perspective. The CPA stands ultimate in the field of internal auditing in its merit and paves the way for a fast track global accounting career.

CPA US Course Certification: How to be a Certified Public Accountant? :- The question might be raised why an accounting professional will seek CPA US course certification? To answer , we have to consider appropriate reasons like increased job opportunities, higher salary and finally…..continue reading….

Conclusion

Summing up, it can be stated that there are signals in the horizon which indicate the possibility of replacenent of accountants doing low value repetitive jobs by automation. This is happening by continuous introduction of various accounting softwares, AI and Machine Learning procedures.

To prevent the extinction, accountants need to upskill themselves by combining technology with the professional knowledge and skill sets. In this respect, the two courses mentioned above (US CMA course, CPA US course) are very much useful for an accountant to get a high value job or to transform from a low value job profile to a high one in global perspective.

Choose the best US CPA and US CMA institute in India, Africa, and Middle East – Uplift Pro

Uplift Pro is one of the top training institutes for the US CMA, US CPA US course, US CIA course in India, Africa, and Middle East. Uplift Pro is also an Indian partner of GLEIM, US and an IMA US authorized CMA US study center. Our team consists of seasoned professionals and entrepreneurs from IIEST, IITs, London Business School, and ULCA who have decided to provide a strong backup to young ambitious students and professionals to reach their desired career destinations in an organized way.

Some of the exclusive features include –

A. Authorized partner of IMA and Gleim in India

B. High pass rate of 85 %

C. Live online classes ensuring that the regular office working hours is least impacted

D. 1:1 personal support from our 30 plus years of experienced US CMA and CPA US course certified faculties

E. Affordable course fees

F. “Till you pass” guarantee assuring that you may attend our live online classes at no extra cost until you pass

G. 100 % placement assistance for jobs

Request for Live Demo class / contact at +91-8787088850 to book your seats now.

Hey there! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to get my website to rank for some

targeted keywords but I’m not seeing very good success.

If you know of any please share. Cheers! You can read similar blog here:

Blankets

Hey! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Hi! Do you know if they make any plugins to

help with Search Engine Optimization? I’m trying to get my website to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Thank you! You can read similar blog here: Code of destiny

Its like you learn my mind! You seem to grasp a lot approximately this,

like you wrote the guide in it or something.

I feel that you simply could do with a few percent to force the message house a little bit,

however instead of that, that is great blog. A fantastic read.

I will definitely be back.

I am extremely inspired along with your writing abilities and also with the layout for your blog. Is that this a paid topic or did you modify it your self? Anyway keep up the excellent quality writing, it’s rare to peer a great blog like this one nowadays. I like upliftprofessionals.in ! It’s my: Beehiiv

I’m extremely inspired together with your writing abilities as smartly as with the layout on your blog. Is that this a paid subject or did you modify it yourself? Anyway stay up the nice high quality writing, it is rare to peer a nice weblog like this one today. I like upliftprofessionals.in ! It is my: Instagram Auto follow

Helpful information. Lucky mme I discovered your web

site accidentally, and I am surprised why this coincidence didn’t

took place in advance! I bookmarked it. https://menbehealth.wordpress.com/