The availability of accounting professionals with realistic knowledge and expertise are still in derth in India. Professional courses like US CMA , CPA US course, CIMA, CIA, CFA focused on skill building in relation to applicable education and training at par with the need of the growing industry pattern are gaining importance day by day to mend the gap.

After the completion of a specialized global professional course, the employability of a job aspirant increases . This is because of the acceptability of these courses in the companies. The professional courses impart advanced skills, upgrade the inherent skills. Therefore, these courses benefits both freshers and working professionals .

Among such courses CPA US course (Certified Public Accountant) is being considered as the most demanding and coveted certification for finance and accounting professionals. A professional having US CPA credential obtained through clearance of the Uniform CPA exam administered by AICPA (American Institute of Certified Public Accountants) enforces good professional standards in the field of accounting.

About CPA US course

CPAs have expertise in US federal income tax, US GAAP, and many other areas of US financial and accounting laws. The CPA certification is respected all over the world, in the global accounting arena and it’s a US designation certifying the professionals in the US accounting to perform taxation and auditing tasks.

A CPA US course qualification is similar to the Indian CA qualification. Additionaly the CA qualification, a CPA will have knowledge of :

1. US Generally Accepted Accounting Principles (GAAP)

2. IFRS (International Financial Reporting Standards)

3. Generally Accepted Accounting Standards (GAAS)

4. US federal taxation and business laws

This provides them an edge over the CAs in India.

Eligibility for the CPA US course examination

1. To appear for the CPA US course examination, it is a prerequisite to becoming a member of the Institute of Chartered Accountants of India.

2. You should be a member of the Company Secretaries in India, Member of the Institute of Cost and Works Accountants in India.

3. It is a prerequisite to a clear Master of Commerce and MBA

Career opportunity of CPA US course

The US CPA opens wider scope to work for both public and private sectors .

Below are the various career options found in the job market:

1. A CPA as Public Accountant

In public and private organizations, the auditing of financial statements is a highly specialized job. As an important member in a public accounting firm, CPAs circumscribe accounting, auditing, tax, and consulting services for clients of any capacity.

2.Role of a CPA in Business, Public Sector and NGOs

In this wider area, CPAs used to occupy a variety of designations ranging from financial analysts and staff accountants to CFOs. CPAs are responsible for recording, analyzing, and reporting financial information of organizations. The CPAs performs budgeting and internal auditing functions.

3. Role of CPAs in Specialized Sectors

CPAs provide services in certain specialized areas by conducting risk assessments. It plays an immense role by implementation of systems improvements and revisions.

The CPAs helps in management of information technology to handle enormous amounts of data generation.

4. Role of CPAs as Financial Advisor

CPAs perform the role of financial advisors to individuals by making informed financial decisions on their behalf to help them manage their financial assets associated with personal investments, savings etc like purchase of property, education, business planning to retirement planning to name a few.

In India, some of the decent jobs which a CPA US can get are listed below:

A. Director

B. Senior Financial Analyst

C. Corporate Controller

D. Risk and Compliance assessing professional

E. Personal Financial Adviser

F. Internal Auditor

G. Software Accountant

There are many job opportunities in India for qualified professionals. Firstly, there are the BIG4s – Deloitte, EY, etc. where the CPAs have opportunities. Seconaly, apart from the big 4s there are many more international companies like PwC India hiring CPAs even right now. According to Naukri.com there are around 26,426 job openings for a CPA in India as of now and this number keeps increasing, changing every day.

Earning your US CPA course is a lengthy process and one that will cost a lot of money to see through to the end. The benefits of being a CPA helps to get more pay . Most people who decide to pursue the CPA feel confident that the ROI is worth it. Perks of being a CPA include an increase in salary, a diverse selection of job opportunities, job security, and other benefits like the opportunity to travel.

Companies hiring CPA professionals

There is a wide assortment of opportunities for students, who qualify for the CPA US course exam in India an across the globe. For example, many global organizations having Indian offices hire the public certified accountants. As the number of CPAs is visibly less in Indian Market, the majority of the companies are sponsoring the CPAs.

There are many jobs in Financial Planning and Analysis, Taxation, Auditing, and different profiles in India. Few of the prominent companies that are hiring Certified Public Professionals include Genpact, Philips, Deloitte, Accenture, Cognizant, etc.

If you have sufficient knowledge, you will become successful as a CPA professional. Moreover, the Certified Public Accountants also work for BIG4 companies.

BIG4 happens to be one of the leading professional accounting organizations which provide taxation, assurance, auditing, accounting, risk assessment, and control, consulting, legal services, to a plethora of clients across the globe. Few popular clients of BIG4 include PWC, KPMG, Deloitte, Ernst and Young.

The services, provided by firms are in higher demand. They have gained high popularity in hiring the CPAs in India. A worth mentioning reason why these companies are hiring CPAs is that the Certified Public Accounts can provide a plethora of such services without any hassles. They are known to be well versed in US GAAP and IFRS reporting.

The CPAs work in financial service companies. Their role includes international and financial accounting, corporate governance. They are hired for different types of profiles in the financial services firm.

CPA US Salary in India

Completing US CPA course helps professionals to make more money for the same job with out CPA. Typically, the US CPAs gets more than 15-20% than non-CPAs.

Research conforms the pay gap as high as 50% between a CPA and a non-CPA. The variation in salaries reflects differences in the size of a firm, the location, level of education, and professional credentials.

According to the 2020 Robert Half Salary Guide for Accounting and Finance Professionals, hiring managers in every enterprise are scrambling to find professional accounting professionals, largely CPAs.

As per Indeed Data, currently, the US CPA salary in India is INR 9.25 LPA. On the otherhand, in Indian Big 4 companies, it ranges from 12.5 to 20.4 LPA respectively.

US CPA salary in India ? In India a fresh CPA starts with a minimum salary of INR 6 Lakh annually in a Big4 or MNC. The salary increases at higher rate compared to non-certified peers. Meanwhile, a CFO can earn more than INR 1 Cr annually.

US CPA course career

Being an US CPA isn’t just a job, it’s actually a whole series of jobs and stepping stones that would conclude into an amazing career. The US CPA course opens up new opportunities including greater career path choices from which to choose. US CPA course open opportunities to get jobs abroad or new local opportunities and at a large or small accounting practice.

As the number of US CPA in India is visibly less in the Indian Market, the majority of the companies are sponsoring the CPAs. There are a plethora of jobs in Financial Planning and Analysis, Taxation, Auditing areas. Few of the prominent companies that are hiring Certified Public Professionals include Genpact, Philips, Deloitte, Accenture, Cognizant, etc.

Earning your US CPA course is a lengthy process and one that will cost a lot of money to see through to the end. Most people who decide to pursue the CPA feel confident that the ROI is worth it. Perks of being a CPA include an increase in salary, a diverse selection of job opportunities, job security, and other benefits like the opportunity to travel.

Summary

Considering the above facts, it can be stated that demand of US CPAs in India is growing to a good extent. The US CPA job opportunities in India is increasing with time. If you are willing to build a successful career and earn an attractive package in the field of accounting, the US CPA course might be a smart choice for you.

A prominent reason why people choose to become CPA is that they can find better and more opportunities within a short period. Therefore, they can gain career success without many hurdles. US CPA course is believed to be a powerful certification which will bring stability in the career.

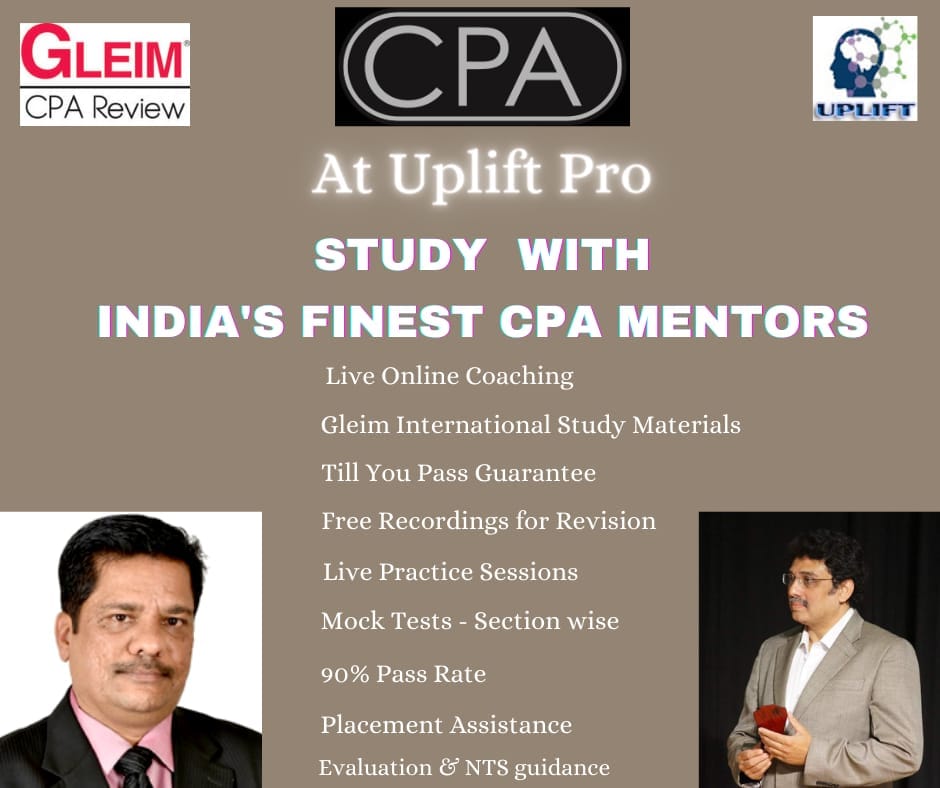

If you are a CPA aspirant, you may seek support from Uplift Professionals, a quality training institute for US CPA in India.

About the top US CPA training institute in India, Africa, and Middle East – Uplift Pro

Uplift Pro is one of the top training institutes for the US CPA, US CMA, US CIA courses in India, Africa, and Middle East. Our team consists of seasoned professionals and entrepreneurs from IIEST, IITs, London Business School, and ULCA who have decided to provide a strong backup to young ambitious students and professionals to reach their desired career destinations in an organized way.

Uplift Pro, is an authorized partner of Gleim in India, provides you with authentic Gleim materials, updates and Live Online Interactive Classes for CPA US by internationally experienced veteran mentors. All at an Indian Cost.

Some of our exclusive features include –

A. Affordable US CPA course fees

B. CPA certified veteran TEAM of faculties

C. Live online classes ensuring that the regular office working hours is least impacted. Moreover, they provides class recordings.

D. 1:1 personal support from our 30 plus years of experienced CPA certified faculties ensuring that all our students pass the US CPA course

E. “Till you pass” guarantee assuring that students can attend our live online classes at no extra cost until you pass

F. Premium study materials with practice questions bank enabling students to pass the US CPA exam in India and rest of the world

G. Administrative guidance on US CPA evaluation procedure

H. Placement assistance

Request for Live Demo class / contact at +91-8787088850 to book your seats now.

I think this is among the most important info for me. And i’m glad reading your article. But want to remark on some general things, The website style is wonderful, the articles is really nice : D. Good job, cheers

What i don’t understood is actually how you are not really much more well-liked than you may be right now. You are so intelligent. You realize therefore significantly relating to this subject, made me personally consider it from a lot of varied angles. Its like women and men aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs excellent. Always maintain it up!

Helpful information. Fortunate me I found your site accidentally, and I’m surprised why this coincidence did not happened earlier! I bookmarked it.

I have been checking out a few of your posts and i can state pretty good stuff. I will surely bookmark your website.