An Enrolled Agent (EA) is a licensed tax professional who represents taxpayers that face asset forfeiture, are undergoing audits, or who want to file appeals for various decisions of the Internal Revenue Service (IRS). Specifically, those with this certification, similar to a certified public accountant (CPA), can represent taxpayers before the Internal Revenue Service.

EAs has become a bona fide career with the benefits of technical experience, federal oversight of the practice, governmental oversight, and even their own publications. In fact, EA certification is the highest credential the IRS offers.Though not quite at the level of a CPA or a lawyer, EAs are able to offer a broad scope of services to their clients.

Also, unlike a certified public accountant, these agents do not need approval from a state board and they do not need state licenses; their professional certification is accepted throughout the nation. Outside of standard tax prep, you and your client will also enjoy client-EA confidentiality. Thus, when you are representing a taxpayer in a matter involving an audit or Internal Revenue Service collections, you can discuss the content of those filings with protected confidence and security.

These days, the profession is still available to nearly anyone. No special education is required. However, all licensed EAs must pass a special enrollment examination (SEE) and tend to do better with previous employment and work experience in the field. The IRS oversees the EA exam through Prometric that likely offers a testing center near you. In 1994, the initials E.A. were officially recognized by the Treasury Department.

A licensed enrolled agent (EA) has many duties and responsibilities, both to their clients and to the Internal Revenue Service. Failure to comply with rules can result in suspension, disbarment, or other penalties. Conceivably, criminal charges could be filed in extreme circumstances. However, you will enjoy a long and fruitful career and nearly unlimited earning potential in the private sector if you maintain an honorable practice.

When becoming an enrolled agent you will have several obligations and one of the first obligations is to the IRS. If the agency requests documentation from you, you must comply with the request or order for documents. When you receive such a request, you should scrutinize it and determine that it follows tax law and that the requested documents do not violate your client-EA confidentiality.

After all, while it is important to be in compliance with the IRS, it’s also important to fulfill on any contractual agreements you have with your client. Not only are you required to submit any lawfully requested documentation, but you must also be available to testify before the IRS.

As you work with a client, it is your duty to inform them of various statutes and rules. For instance, if you see that they may be omitting certain information from their paperwork when you file it, you must let them know that their action will carry consequences. Failure to properly inform your client may result in negative consequences for both you and your client. These types of due diligence are required throughout your practice.

The Benefits of Becoming an Enrolled Agent

1. Unlimited Representation before the IRS

The U.S. CPA license is one of the most respected accounting certifications. But when it comes to representation before the IRS, the EA is right there with the CPA. Therefore, if certain obstacles prevent you from earning the CPA, but you plan to specialize in tax, you can get the EA license and be just as capable. The IRS grants both CPAs and EAs the ability to represent a taxpayer without any limitations.

As an EA, you will always be in the IRS National Database so long as you maintain the continuing education (CE) and Preparer Tax Identification Number (PTIN) requirements. As a result, you can handle any type of tax matter (even audits, collections, and appeals), represent clients before any IRS office, and represent any taxpayer in any state. You don’t ever have to turn away clients because of situations outside your professional clearance level.

2. Verified Tax Expertise

The IRS doesn’t award unlimited representation to just anyone. No, everyone knows that with the IRS’s stamp of approval, enrolled agents are the real tax experts. That’s because, in the process of earning the EA designation, you will increase your tax knowledge and abilities. Then, once you have the credential, you’ll have the credibility that comes with it. The Department of Treasury regulates the EA designation, so all 50 states recognize and respect it. The EA’s universal acceptance and esteem stand in stark contrast to the CPA license, which the state boards of accountancy grant individually.

The variance among CPA license applications and requirements as well as the lack of tax depth in the CPA Exam syllabus means CPAs may or may not be capable of providing knowledge and services equivalent to that of an EA. Accordingly, CPAs don’t usually have the same amount of passion to keep up with and perform tax services. So, when you have the EA license, you’ll be known as the most committed and qualified of tax professionals. Then, when CPAs decline opportunities to provide tax assistance, you can swoop in and deliver the help clients need.

3. Limitless Earning Potential

Because you’ll be a confirmed tax expert with unlimited rights before the IRS, you won’t have to turn down any chance to make money by supplying tax services. Instead, you can complete more complicated tax returns, which means you can increase your earning potential. The services you can offer include helping people with audits, preparing and filing documents on a client’s behalf, attending hearings and conferences in place of your client, and providing written advice to third parties on the tax implications of business transactions.

These services are lucrative not only because they are vast, but also because they are in demand across all industries. All kinds of entities require the assistance of enrolled agents, such as accounting firms, law firms, investment firms, corporate accounting departments, state departments of revenue, banks, and private practices. With so many work opportunities available, you’ll have the freedom to decide if you’d like to work full-time or part-time; year-round or just during busy season; for yourself or someone else. In fact, with the independence you’ll have to work as much as you like and on whatever kind of accounts you like, your earning potential is unlimited.

4. Recession-Proof Job Security

Basically, as long as people must pay taxes, they’ll need the aid of enrolled agents. Therefore, enrolled agents will be in demand indefinitely. Even when the country goes through tough economic times, you can stay afloat on the EA designation. Likewise, in light of continuous changes to the tax code, the enrolled agent designation is always valued. And that’s not to mention the increasing need for enrolled agents in healthier economic climates. The IRS has been bumping up the number of examinations they perform each season, so more people are calling on enrolled agents to get them through audits each year.

5. Educational Requirements

The IRS does not require any specific educational background to become an enrolled agent. Applicants have to pass each section of the three-part exam and undergo a background check. Aspiring EAs may find that an accounting degree sets them apart from their peers. Candidates who already hold undergraduate degrees may boost their skills and knowledge with a certificate in accounting or master’s in taxation.

Jobs You Can Have with an Enrolled Agent Credential

Public Accounting Firm Tax Staff

Public accounting firms are a great place for EAs to work for a variety of reasons: they often offer great benefits, including higher than normal paid time off and a strong sense of job security. At a public accounting firm, EAs can work as tax staff, helping to prepare returns and representing clients before the IRS. EAs will likely work with a variety of clients, from individuals to corporations, and will get highly experienced guidance on tax related matters. Public accounting is a great place to start your career and jump into other jobs, or it can be a great place to continue your career well into the future depending on your need for growth and your firm’s ability to provide it.

Small Accounting Firm Tax Staff

There are plenty of smaller CPA firms out there who have more clients than they know what to do with. This is a great opportunity for an EA – they can come in and take quite a few tax related matters off a small practice owner’s hands. EAs can take on a variety of responsibilities and grow into the role of a tax professional. Small accounting firms can also offer a lot of benefits in terms of scheduling, time-off, work from home opportunities, and growth.

Banking

Banks are regulated by the Federal Reserve and therefore have to deal with government oversight on a consistent basis. Having an EA on staff can help banks work with regulations while also making sure they are tax compliant. Banks offer similar benefits to public accounting firms: good salary, good benefits, and high job security. They also have an added benefit of having more paid holidays than most businesses. However, you may have less flexibility in terms of your schedule, so you’ll have to evaluate what’s most important to you in your career.

Law Firm Staff

Tax law firms will definitely benefit from having an EA on staff who can represent clients before the IRS (for example, if the client was audited) and deal with any IRS related notices received on behalf of the client. Law firms are also small businesses which may benefit from having tax personnel on their staff to help them handle their small business taxes. Law firms offer different benefits depending on size. Similar to public accounting firms vs small CPA firms, a large firm will likely offer better pay, more security, and better benefits, while a small firm will offer more ownership and more flexibility.

Investment Firm Staff

Investment firms need tax professionals on staff who can help them minimize the tax obligations of their clients. An EA can advise investment firm staff on how to handle the purchase and sale of investments to ensure the goals of clients are met in any given tax year. Larger investment firms tend to offer very good benefits for their staff, as well as more progressive flexibility. If you’re an EA and you’re interested in investing, this would be a great opportunity to do something you enjoy while also having a lot of salary and work-time flexibility.

Department of Revenue Staff

A great benefit of being an EA is having the ability to work for the IRS or state departments of revenue. This is at the heart of an EAs core duties and responsibilities, and you’ll be guiding people through tax obstacles on a daily basis. Working in government means you’ll likely have better vacation, health, and retirement benefits, as well as increased job security. You may not be paid quite as well as if you worked in the private sector, but you may enjoy knowing you’re working for an entity meant to serve the public.

CEO or Owner of Your Own Business

Many EAs start their own tax preparation and planning businesses. You would perform all the essential duties of an EA: tax preparation, tax strategy, and representing clients before the IRS. You may also incorporate bookkeeping services into your practice, or start a small business with a partner who does advising and accounting related work to have a fully rounded accounting practice.

The sky’s the limit when you start your small business, and it really gives you a chance to work with your passions. Having your own business offers the greatest benefits while posing the largest risk. You may have unlimited flexibility, but you’ll have to earn clients to make money. You can make a lot of money, but you may have more clients than you want to deal with. It’s all about balance when owning your own business.

Staff of Small Businesses in Various Industries

Most every business would benefit from having an EA on staff. Small business owners don’t usually have the time to deal with tax related matters or IRS notices, and would really benefit from having someone on staff who could help them with their accounting throughout the year and their taxes during tax season. Having an EA in house also means small business owners can actively take advantage of tax minimizing decisions on a regular basis. Each of these areas offer upsides and downsides, and different firms within each area may offer different opportunities. You may find a bank that offers a great salary and flexible schedule, it’s just a matter of looking at your options.

Also, keep in mind that you don’t have to pick one of these careers to be in forever. You may start out in a public accounting firm, move to a bank, and then start your own business. Being an EA means you have the opportunity to try out a few different areas and see what you like. It’s a great career choice for anyone who enjoys helping people while also earning a great salary and having a fair amount of flexibility.

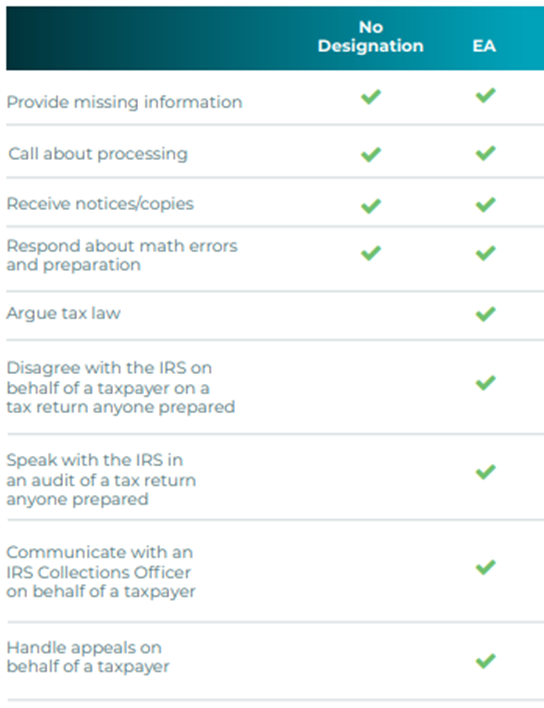

This excerpt from a chart produced by the National Association of Tax Professionals (NATP) breaks down the rights the candidates have after becoming an EA:

EA Job Opportunities in India

An Enrolled Agent is a person who has earned the privilege of preparing US tax returns and also representing taxpayers before the Internal Revenue Service (IRS) by passing a three-part comprehensive IRS test covering individual and business tax returns. The course is really useful if you wish to continue any kind of US taxation jobs.There is a wide scope of job opportunities for many who wish to pursue this field.

Many opportunities lie in the US as the course deals with US taxation. Indian ITES – BPO and KPO industry servicing International and US Financial and Accounting domain is growing leaps and bounds. All these firms including BIG4, require knowledgeable and skilled resources to service their US and International clients on US taxation. Enrolled Agent being the highest credential awarded by IRS for US taxation practice; Job seekers with EA qualification are most preferred resources by these companies.

The course is really useful if you wish to continue any kind of US taxation jobs. There is a wide scope of job opportunities for many who wish to pursue this field. Many opportunities lie in the US as the course deals with US taxation.

· Indian ITES – BPO and KPO industry servicing International and US Financial and Accounting domain is growing leaps and bounds. All these firms including BIG4, require knowledgeable and skilled resources to service their US and International clients on US taxation. Enrolled Agent being the highest credential awarded by IRS for US taxation practice; Job seekers with EA qualification are most preferred resources by these companies.

· All fortune 500 companies which have their shared services, International Banks , Financial Institutions , Big 4 and other accounting companies need EA’s in their system . New FATCA (Foreign accounting tax compliance act) rules stipulate that all the Indian banks and Financial Institutions also need to submit reports on transactions entered by US investors. EA’s will be a prime resource to handle these work processes.

Enrolled agent will have opportunity to work in:

· Big 4 audit firms

· Accounting and taxation BPO’s & KPO’s

· Shared service centers

· International Banks & FIs BPO & KPO’s

· Indian banks & FIs

· Indian International companies

Average Enrolled Agent Salary in India

₹460,838/ year

The average salary for an Enrolled Agent is ₹460,838

Base Salary

₹100k – ₹730k

Bonus

₹58k – ₹110k

Total Pay

₹120k – ₹730k

Based on 19 salary profiles (last updated Mar 08 2022) Source: PayScale

Average Deloitte Tax Consultant salary in India is ₹ 6 Lakhs per year for employees with less than 1 year of experience to 4 years. Tax Consultant salary at Deloitte ranges between ₹ 3.9 Lakhs to ₹ 7.6 Lakhs per year.

Summary

As an Enrolled Agent you have opportunities to increase your salary by charging a fee for representation services, tax advice, or opinions on tax matters. EAs can work year-round, representing taxpayers in examinations, audits, installment agreements, collections and appeals. Armed with the ability to provide additional services, the Enrolled Agent credential increases the value you bring to clients, but it also increases the revenue potential that current clients bring to a tax practice. For these reasons, EAs are in high demand and often earn a higher salary than tax return preparers who are unable to offer these services.

On average, EAs can earn more per year than tax preparers. Individuals who are considering a new career path may find that becoming an enrolled agent is the right choice. Offering excellent job security and the opportunity to have jurisdiction throughout the United States, the position of enrolled agent can provide a good salary along with a rewarding career. Candidates who already hold undergraduate degrees may boost their skills and knowledge with a certificate in accounting or master’s in taxation.

Enrolled Agent Training in India

Uplift Professionals is a premier training Institute for EA program in India.

Uplift Pro’s EA Packages

| Gleim Premium EA Review System @ $629 | Gleim Traditional EA Review System @ $529 |

| Largest and most Realistic Bank of Exam-Quality Questions | Largest and most Realistic Bank of Exam-Quality Questions |

| Smart Adapt Technology for Guided and Personalized Study | Smart Adapt Technology for Guided and Personalized Study |

| Over 30 Hours of Expert-Led Videos | Gleim Study Planner helps keep your studies on track |

| Access until you Pass Guarantee for Peace of Mind | Personal Counselor Support |

For more Information/Guidance, Contact:

Good day! Do you know if they make any plugins to help

with SEO? I’m trying to get my site to rank for some targeted keywords but

I’m not seeing very good results. If you know of any please share.

Many thanks! I saw similar blog here: Warm blankets

So whether or not you love darkish chocolate, extravagant desserts or only a easy snickerdoodle cookie, we’re going to guess what type of job you have proper now!

sugar defender As a person who’s constantly

been cautious concerning my blood sugar level, discovering Sugar Defender

has actually been a relief. I really feel a lot extra in control, and my current exams have actually revealed positive

improvements. Recognizing I have a reliable supplement to support my routine gives me assurance.

I’m so happy for Sugar Defender’s impact on my health and wellness!

You’re so cool! I do not believe I’ve read anything like this before. So good to find another person with genuine thoughts on this topic. Really.. many thanks for starting this up. This web site is something that is needed on the web, someone with some originality.

I blog often and I genuinely thank you for your information. This article has really peaked my interest. I will take a note of your blog and keep checking for new information about once per week. I opted in for your RSS feed as well.

Excellent article! We will be linking to this great article on our website. Keep up the good writing.

I must thank you for the efforts you have put in penning this blog. I am hoping to see the same high-grade content from you later on as well. In truth, your creative writing abilities has encouraged me to get my very own website now 😉

I would like to thank you for the efforts you’ve put in penning this site. I really hope to view the same high-grade blog posts by you in the future as well. In truth, your creative writing abilities has inspired me to get my own blog now 😉

카지노 사이트의 재미있는 게임을 느껴보고 싶으신 분들, 곧바로 최고의 카지노 플랫폼을 방문해보세요. 에볼루션 카지노에서 놀라운 기회를 만나보실 수 있습니다.

Great information. Lucky me I ran across your website by accident (stumbleupon). I’ve saved as a favorite for later.

I’d like to thank you for the efforts you have put in penning this site. I am hoping to see the same high-grade blog posts by you in the future as well. In truth, your creative writing abilities has encouraged me to get my own blog now 😉

I really like reading through a post that can make men and women think. Also, thanks for allowing for me to comment.

The next time I read a blog, Hopefully it doesn’t disappoint me as much as this one. I mean, Yes, it was my choice to read through, but I really believed you would have something interesting to say. All I hear is a bunch of whining about something you could fix if you weren’t too busy looking for attention.

Everything is very open with a precise clarification of the issues. It was definitely informative. Your website is useful. Thanks for sharing!

It’s difficult to find educated people about this subject, but you seem like you know what you’re talking about! Thanks

Great site you’ve got here.. It’s hard to find excellent writing like yours these days. I seriously appreciate people like you! Take care!!

This website was… how do you say it? Relevant!! Finally I have found something that helped me. Kudos!

I’m more than happy to uncover this great site. I want to to thank you for your time due to this fantastic read!! I definitely liked every bit of it and i also have you book marked to check out new stuff on your site.

When I originally commented I clicked the -Notify me when new surveys are added- checkbox and from now on when a comment is added I receive four emails with the exact same comment. Possibly there is in any manner you’ll be able to eliminate me from that service? Thanks!

Very good blog post. I absolutely love this site. Keep it up!

I was able to find good info from your content.

Aw, the labyrinth was such a good post. From opinion I have to make a note of enjoy this further . . . slacking and as a consequence real world project carryout a top notch article… anyhow assist with Naturally i say… I personally put it off a large amount certainly not the slightest bit appear go undertaken.

I?ll immediately seize your rss feed as I can’t in finding your email subscription link or newsletter service. Do you have any? Kindly let me recognise in order that I could subscribe. Thanks.

I could not refrain from commenting. Perfectly written!

Spot on with this write-up, I seriously believe this amazing site needs far more attention. I’ll probably be back again to read more, thanks for the information!

I completely understand everything you have said. Actually, I browsed through your additional content articles and I think you happen to be absolutely right. Great job with this online site.

Hi there, I do think your web site could be having internet browser compatibility problems. When I take a look at your website in Safari, it looks fine however, when opening in Internet Explorer, it’s got some overlapping issues. I simply wanted to provide you with a quick heads up! Apart from that, great website.

You have made some really good points there. I checked on the net to find out more about the issue and found most people will go along with your views on this website.

[…]we like to honor many other internet sites on the web, even if they aren’t linked to us, by linking to them. Under are some webpages worth checking out[…]…

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

But let’s not forget the triple-villain team of Aniston, Spacey, and Ferrell, which infused even more humor (and craziness) into the comedy.

Hey very nice site!! Man .. Beautiful .. Amazing .. I’ll bookmark your website and take the feeds also…I’m happy to find numerous useful information here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .

I adore your website.. excellent colours & theme. Did an individual design this site oneself or maybe have you actually rely on someone else to do it for you personally? Plz answer while I!|m planning to design and style my very own blog site as well as want to learn where by u became this specific through. thanks

The guidelines you discussed here are extremely priceless. Rrt had been such a pleasurable surprise to get that waiting for me once i woke up now. They are usually to the point and easy to grasp. Thanks for your time for the thoughtful ideas you’ve got shared here.

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have bookmarked you to check out new stuff you post.

Howdy! I simply would like to give you a big thumbs up for your excellent info you have right here on this post. I’ll be returning to your blog for more soon.

Simply wish to say the post can be as surprising. The clearness in your publish is simply nice and will be able to assume you’re educated within this subject. Fine along with your agreement i want to in order to clutch the Rss to keep up to date along with returning around near post. Thank you a million as well as please continue the actual gratifying function.

I came across your blog site on the internet and check a couple of of your earlier posts. Still keep in the very great operate. I simply extra up your Feed to my personal Windows live messenger News Readers. Searching for forward to reading far more from you afterwards!?-

I enjoy your blog site.. good shades & topic. Would you actually style and design this site oneself or maybe did a person bring in help to do it for you personally? Plz respond seeing that I!|m seeking to design my personal web site and also want to understand exactly where you got that through. thank you

Greetings! Very useful advice in this particular post! It is the little changes that produce the most significant changes. Many thanks for sharing!

It’s in point of fact a nice and helpful piece of information. I am satisfied that you shared this useful info with us. Please stay us informed like this. Thanks for sharing.

Podem recomendar outros blogues/sites/fóruns que tratem dos mesmos temas?

love your imagination!!!! great work!! oh yeah.. cool photography too.

We offer the best practical and most applicable solutions. All our Sydney plumbers are experienced and qualified and are able to quickly assess your problem and find the best solution.

|Tato stránka má rozhodně všechny informace, které jsem o tomto tématu chtěl a nevěděl jsem, koho se zeptat.|Dobrý den! Tohle je můj 1. komentář tady, takže jsem chtěl jen dát rychlý

I like the helpful information you provide in your articles. I’ll bookmark your weblog and check again here regularly. I’m quite certain I will learn lots of new stuff right here! Best of luck for the next!

We still cannot quite think that I could truthfully often be those types of checking important points entirely on your blog post. My children and so i are sincerely thankful for one’s generosity too as for giving me possibility pursue our chosen profession path. Information you information I received with your web-site.

Spot on with this write-up, I truly feel this website needs much more attention. I’ll probably be back again to read through more, thanks for the information.

Díky moc!|Hej, jeg synes, dette er en fremragende blog. Jeg snublede over det;

I really appreciate this post. I’ve been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thank you again!

The the next occasion I read a blog, Hopefully it doesnt disappoint me around this blog. What i’m saying is, I know it was my substitute for read, but I really thought youd have something interesting to express. All I hear is often a number of whining about something you could fix in the event you werent too busy in search of attention.

Undeniably believe that which you said. Your favorite reason appeared to be on the internet the easiest thing to be aware of. I say to you, I certainly get irked while people think about worries that they plainly do not know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people could take a signal. Will likely be back to get more. Thanks

Wow this game looks uber. How is a kid supposed to get any learning done with all-knowing distractions like this?!?!

You need to get involved in a contest for starters of the best blogs over the internet. I will suggest this website!

This is the correct blog for everyone who really wants to learn about this topic. You realize so much its almost difficult to argue with you (not that I just would want…HaHa). You actually put a whole new spin with a topic thats been discussing for some time. Great stuff, just wonderful!

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

I’m impressed, I must say. Actually rarely can i encounter a weblog that’s both educative and entertaining, and without a doubt, you might have hit the nail around the head. Your notion is outstanding; ab muscles something that there are not enough consumers are speaking intelligently about. I’m happy which i came across this in my look for something in regards to this.

After study a few of the blog articles with your site now, and that i genuinely as if your means of blogging. I bookmarked it to my bookmark website list and are checking back soon. Pls have a look at my internet site in addition and figure out what you think.

Hey there guys, newbie here. I’ve lurked about here for a little while and thought I’d take part in! Looks like you’ve got quite a good place here

Having read this I thought it was rather informative. I appreciate you spending some time and energy to put this informative article together. I once again find myself personally spending a lot of time both reading and commenting. But so what, it was still worthwhile.

I needed to thank you for this great read!! I definitely enjoyed every bit of it. I have got you saved as a favorite to check out new things you post…

I discovered your site website on bing and appearance many of your early posts. Preserve within the really good operate. I just now extra increase Rss to my MSN News Reader. Seeking forward to reading much more of your stuff afterwards!…

When I came over to this post I can only look at part of it, is this my net browser or the internet website? Should I reboot?

That is a very good viewpoint, however isn’t create any kind of sence at all preaching about that will mather. Just about any approach gives thanks and also thought about aim to reveal your current article in to delicius but it surely is apparently an issue using your sites is it possible please recheck this. many thanks once more.

Nice site, very well made ~ Please keep updating, I will def read more. I’ll bookmark it and be backk!

It is truely good post, but I do not see everything completely clear, especially for someone not involved in that topic. Anyway very interesting to me.

This really is a good influencing take on this specific point. I’m pleased you shared your feelings as well as smart ideas and I discovered that i am in agreement. I certainly value your very clear writing along with the effort you may have you spend writing this post. Loads of thanks for this sturdy work additionally very good luck with the site, I will be awaiting new subjects within the future.

This is a topic that’s close to my heart… Best wishes! Exactly where can I find the contact details for questions?

I like this post, enjoyed this one thanks for posting .

Thanks for the sensible critique. Me and my neighbor were just preparing to do a little research about this. We got a book from our local library but I think I learned more from this post. I am very glad to see such fantastic info being shared freely out there..

Hello very cool site!! Guy .. Beautiful .. Wonderful .. I will bookmark your site and take the feeds also…I am satisfied to find a lot of helpful information right here within the put up, we’d like work out more strategies in this regard, thanks for sharing.

Your content is valid and informative in my personal opinion. You have really done a lot of research on this topic. Thanks for sharing it.

You’ve made some good points there. I looked on the internet for more information about the issue and found most people will go along with your views on this site.

Oh my goodness! Incredible article dude! Many thanks, However I am having troubles with your RSS. I don’t understand the reason why I am unable to join it. Is there anybody having similar RSS issues? Anyone that knows the solution will you kindly respond? Thanx.

This website certainly has all of the info I wanted about this subject and didn’t know who to ask.

Nice post. I study one thing tougher on completely different blogs everyday. It should always be stimulating to learn content from different writers and observe a little one thing from their store. I’d choose to make use of some with the content on my blog whether or not you don’t mind. Natually I’ll give you a link in your internet blog. Thanks for sharing.

I believe this really takes me back, such as your blog design too. Is it DPW? ok, good job!

I have watched “boston legal” ever since in my college days, i love to watch courtroom drama“

I am glad for writing to let you be aware of of the magnificent discovery my princess experienced using the blog. She came to find plenty of issues, not to mention what it’s like to possess a great teaching character to get many others just know a number of advanced things. You really did more than visitors’ expectations. Thank you for giving such insightful, healthy, revealing as well as fun guidance on this topic to Lizeth.

Wow! This can be one particular of the most useful blogs We have ever arrive across on this subject. Actually Excellent. I’m also an expert in this topic therefore I can understand your hard work.

Good web site! I truly love how it is easy on my eyes and the data are well written. I’m wondering how I could be notified whenever a new post has been made. I have subscribed to your RSS which must do the trick! Have a great day!

This excellent website certainly has all of the information and facts I wanted concerning this subject and didn’t know who to ask.

I’m impressed, I must say. Seldom do I come across a blog that’s both equally educative and amusing, and without a doubt, you have hit the nail on the head. The issue is something which too few folks are speaking intelligently about. I am very happy that I stumbled across this in my search for something relating to this.

Right here is the perfect web site for everyone who wishes to understand this topic. You realize a whole lot its almost tough to argue with you (not that I really will need to…HaHa). You certainly put a fresh spin on a topic that’s been discussed for a long time. Wonderful stuff, just excellent.

I quite like reading a post that will make men and women think. Also, many thanks for permitting me to comment.

An outstanding share! I have just forwarded this onto a co-worker who was doing a little research on this. And he in fact bought me lunch simply because I stumbled upon it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanks for spending some time to talk about this issue here on your blog.

I randomly browse blogs on the web, and i discover your article to be very informational. I even have already bookmark it on my browser, so as that I will view your blog publish all over again later. Additionally, i’m wondering whether or not or not your weblog is open for link exchange, as i really need to trade links with you. I do not normally do that, however I hope that we are going to have a mutual hyperlink exchange. Let me grasp and have an ideal day!

Yet another problem that on the internet chatting might current will be assurance of the person. As it is definitely better in order to discuss on the web, a person who’s really timid or maybe shy sometimes have difficulty keeping up having whom the person truly is usually. The individual alternatively is similar to living together oceans.

I also thought Ken Jeong is really fantastic and another standout comedic performance.

Everyone loves it when folks get together and share views. Great site, continue the good work.

råb ud og sig, at jeg virkelig nyder at læse gennem dine blogindlæg.

Pretty important article. I generally do not comment post, but this time I made an exception, because I have seen here a lot of helpful info. Thank you for the helpful and useful information.

Hip dysplasia is not uncommon in many dog breeds, particularly the larger breeds. It is a deformity of the of the hip joint so the bone and socket do not fit snug. It causes rubbing and degeneration of the bone, inflamation and damage to surounding cartalidge. The condition usually leads to arthritus as the bone is grinded down new mishapen bone grows back causing pain. The good news about Canine Hip Dysplasia is that most cases can be treated to help eliminate or decrease pain, allowing fairly normal levels of activity. Very few dogs today have to be put to sleep to alleviate suffering. There are always choices to be made, but the vast majority of affected animals can live quite comfortable lives. Depending on how severe the damege is pain medication and anti-inflammatory drugs can be given. Another very good supplement to give is glueclosamine. Eventually though surgery might be necessary. . . I would suggest talking to the shelter about having him examined by a vet of your choice before officially adopting him. If you are willing to spend a little money to consult with a vetranarian you’ll be able to discuss this guy’s prognosis. This way you can know beforehand if his case is mild or severe and what treatment options are reccommended and at what cost. I hope I haven’t scared you away from adopting this dog because it may only be arthritis misdiagnosed or a mild case of hip dysplasia, only a vet can tell you for sure.

It’s difficult to acquire knowledgeable people during this topic, however, you seem like do you know what you’re talking about! Thanks

Znáte nějaké metody, které by pomohly omezit krádeže obsahu? Rozhodně bych ocenil

I truly love your site.. Great colors & theme. Did you build this amazing site yourself? Please reply back as I’m attempting to create my own personal site and want to know where you got this from or exactly what the theme is named. Cheers.

Hi there! I simply wish to offer you a huge thumbs up for the great info you’ve got right here on this post. I’ll be returning to your web site for more soon.

Greetings! Very useful advice in this particular post! It’s the little changes that make the largest changes. Thanks a lot for sharing!

Your style is very unique compared to other people I’ve read stuff from. Thanks for posting when you’ve got the opportunity, Guess I will just book mark this site.

Oh my goodness! Amazing article dude! Thank you so much, However I am going through issues with your RSS. I don’t know the reason why I am unable to join it. Is there anyone else having similar RSS issues? Anyone who knows the solution can you kindly respond? Thanks.

Great article! We will be linking to this great content on our site. Keep up the great writing.

I’m impressed, I must say. Seldom do I come across a blog that’s equally educative and interesting, and let me tell you, you have hit the nail on the head. The problem is something not enough men and women are speaking intelligently about. I’m very happy that I found this in my search for something regarding this.

Hi, I do think this is a great blog. I stumbledupon it 😉 I may come back once again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

Conhecem algum método para ajudar a evitar que o conteúdo seja roubado? Agradecia imenso.

This is a good tip especially to those new to the blogosphere. Simple but very precise information… Thanks for sharing this one. A must read post.

I was more than happy to discover this great site. I wanted to thank you for your time for this wonderful read!! I definitely liked every bit of it and I have you bookmarked to check out new information in your website.

Having read this I believed it was really informative. I appreciate you finding the time and effort to put this content together. I once again find myself personally spending a lot of time both reading and commenting. But so what, it was still worth it.

Hi, I do think this is an excellent web site. I stumbledupon it 😉 I will come back once again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

I couldn’t refrain from commenting. Very well written.

That is a really good tip particularly to those new to the blogosphere. Simple but very precise information… Many thanks for sharing this one. A must read post.

bookmarked!!, I like your website.

This is the perfect blog for anyone who really wants to find out about this topic. You understand a whole lot its almost hard to argue with you (not that I actually will need to…HaHa). You certainly put a new spin on a subject that has been discussed for years. Wonderful stuff, just great.

Fiquei muito feliz em descobrir este site. Preciso de agradecer pelo vosso tempo

After looking into a number of the blog articles on your website, I truly like your way of blogging. I saved it to my bookmark site list and will be checking back soon. Please check out my web site as well and tell me your opinion.

Hi there! This blog post could not be written any better! Looking through this post reminds me of my previous roommate! He always kept preaching about this. I most certainly will forward this article to him. Pretty sure he’ll have a good read. Many thanks for sharing!

at web, except I know I am getting familiarity all the time by reading thes pleasant posts.|Fantastic post. I will also be handling some of these problems.|Hello, I think this is a great blog. I happened onto it;) I have bookmarked it and will check it out again. The best way to change is via wealth and independence. May you prosper and never stop mentoring others.|I was overjoyed to find this website. I must express my gratitude for your time because this was an amazing read! I thoroughly enjoyed reading it, and I’ve bookmarked your blog so I can check out fresh content in the future.|Hi there! If I shared your blog with my Facebook group, would that be okay? I believe there are a lot of people who would truly value your article.|منشور رائع. سأتعامل مع بعض هذه|

Greetings! Very useful advice within this post! It’s the little changes that produce the most significant changes. Thanks for sharing!

I blog often and I really appreciate your content. This article has really peaked my interest. I will take a note of your blog and keep checking for new details about once per week. I opted in for your Feed as well.

O conteúdo existente nesta página é realmente notável para a experiência das pessoas,

Good write-up. I certainly love this site. Keep it up!

Pretty! This has been an extremely wonderful post. Thanks for supplying these details.

Great post. I am dealing with a few of these issues as well..

super content. thanks for your effort

råb ud og sig, at jeg virkelig nyder at læse gennem dine blogindlæg.

Way cool! Some very valid points! I appreciate you penning this post and also the rest of the website is really good.

There is certainly a lot to know about this subject. I like all of the points you have made.

This is a topic that’s close to my heart… Take care! Exactly where can I find the contact details for questions?

I couldn’t refrain from commenting. Exceptionally well written!

Hello there, I do believe your web site may be having internet browser compatibility issues. Whenever I take a look at your site in Safari, it looks fine but when opening in IE, it’s got some overlapping issues. I just wanted to give you a quick heads up! Apart from that, fantastic site!

nenarazili jste někdy na problémy s plagorismem nebo porušováním autorských práv? Moje webové stránky mají spoustu unikátního obsahu, který jsem vytvořil.

Way cool! Some very valid points! I appreciate you writing this post plus the rest of the site is very good.

Hi! I could have sworn I’ve visited your blog before but after browsing through a few of the articles I realized it’s new to me. Regardless, I’m certainly happy I discovered it and I’ll be book-marking it and checking back regularly!

Spot on with this write-up, I truly feel this amazing site needs much more attention. I’ll probably be returning to read through more, thanks for the info!

I could not resist commenting. Exceptionally well written.

문카지노은 safety 해요.

I would like to thank you for the efforts you have put in writing this site. I am hoping to view the same high-grade blog posts from you later on as well. In fact, your creative writing abilities has inspired me to get my own, personal website now 😉

Greetings! Very helpful advice in this particular post! It’s the little changes that will make the most important changes. Many thanks for sharing!

보너스이 많은 문카지노 찾고 있어요.

Hello! I merely would wish to give you a massive thumbs up for the excellent info you’ve got here for this post. I am returning to your blog site for much more soon.

que eu mesmo criei ou terceirizei, mas parece que

May I simply just say what a relief to find someone who actually knows what they’re talking about on the internet. You definitely understand how to bring a problem to light and make it important. More and more people should read this and understand this side of the story. I was surprised you aren’t more popular since you definitely possess the gift.

Good post. I learn something totally new and challenging on blogs I stumbleupon everyday. It will always be interesting to read articles from other authors and use a little something from other websites.

Também tenho o seu livro marcado para ver coisas novas no seu blog.

This blog was… how do I say it? Relevant!! Finally I have found something that helped me. Appreciate it!

Excellent blog here! Additionally your site loads up very fast!

What host are you the usage of? Can I get your affiliate hyperlink to your host?

I desire my web site loaded up as fast as yours lol

I wanted to thank you for this very good read!! I absolutely loved every bit of it. I have got you book marked to look at new things you post…

It’s hard to find knowledgeable people on this subject, however, you seem like you know what you’re talking about! Thanks

Oh my goodness! Impressive article dude! Thanks, However I am going through problems with your RSS. I don’t know why I can’t subscribe to it. Is there anybody having similar RSS issues? Anybody who knows the solution will you kindly respond? Thanx!!

Great information. Lucky me I recently found your blog by accident (stumbleupon). I have saved as a favorite for later!

An intriguing discussion is definitely worth comment. I think that you need to write more on this issue, it may not be a taboo matter but generally people don’t talk about such subjects. To the next! Many thanks!

Hello there! I could have sworn I’ve been to your blog before but after looking at many of the articles I realized it’s new to me. Nonetheless, I’m certainly happy I stumbled upon it and I’ll be bookmarking it and checking back often!

Aw, this was an exceptionally nice post. Finding the time and actual effort to produce a great article… but what can I say… I hesitate a whole lot and never manage to get nearly anything done.

Great site you have got here.. It’s difficult to find good quality writing like yours these days. I really appreciate individuals like you! Take care!!

This site certainly has all of the information and facts I needed about this subject and didn’t know who to ask.

I’m amazed, I must say. Seldom do I encounter a blog that’s both educative and engaging, and without a doubt, you have hit the nail on the head. The issue is something too few people are speaking intelligently about. I am very happy I found this during my hunt for something relating to this.

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I may return yet again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to guide others.

An interesting discussion is worth comment. There’s no doubt that that you ought to write more on this issue, it might not be a taboo subject but usually people don’t speak about these subjects. To the next! Kind regards.

I blog often and I really thank you for your content. This article has really peaked my interest. I will bookmark your blog and keep checking for new information about once a week. I opted in for your Feed as well.

Howdy! This post couldn’t be written any better! Looking through this article reminds me of my previous roommate! He always kept preaching about this. I am going to forward this article to him. Fairly certain he’s going to have a good read. Thanks for sharing!

There’s certainly a great deal to find out about this issue. I like all of the points you made.

Hello there! I could have sworn I’ve visited this site before but after browsing through many of the articles I realized it’s new to me. Anyways, I’m certainly delighted I found it and I’ll be book-marking it and checking back often.

I just love this article. Have you ever thought of a career in writing? If So shoot me a Email I know some people.

Spot on with this write-up, I truly believe this website needs a lot more attention. I’ll probably be returning to read through more, thanks for the advice!

I enjoy reading through a post that will make people think. Also, many thanks for permitting me to comment.

Great blog you’ve got here.. It’s hard to find excellent writing like yours these days. I honestly appreciate people like you! Take care!!

Hello i am so delighted I discovered your blog, I actually discovered you by error, while I was searching Yahoo for something else, Anyways I am here now and would just like to say thanks for a great blog posting and a all round absorbing blog (I also love the theme/design), I do not have time to read it all at the right now but I have bookmarked it and also added your RSS feeds, so when I have time I will be back to read more,

Way cool! Some very valid points! I appreciate you writing this post and the rest of the website is also very good.

Hello! I could have sworn I’ve been to this website before but after browsing through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

A fascinating discussion is definitely worth comment. I think that you should write more on this subject, it may not be a taboo matter but generally people do not talk about such issues. To the next! All the best.

the best addition on our garden that we have are those garden swings, the garden swings made our kids very very happy;

pokračujte v pěkné práci, kolegové.|Když máte tolik obsahu a článků, děláte to?

Good info. Lucky me I discovered your blog by chance (stumbleupon). I have book-marked it for later!

Hi there! Nice post! Please do inform us when we could see a follow up!

I could not resist commenting. Well written!

what is the best way too cool down my house using a box fan and AC at the same time?

Hello there! This article couldn’t be written much better! Reading through this article reminds me of my previous roommate! He continually kept talking about this. I most certainly will forward this post to him. Pretty sure he’ll have a good read. Thank you for sharing!

the accessories for golf are very expensive and joining golf clubs even adds more expense,.

Having read this I thought it was really informative. I appreciate you finding the time and effort to put this information together. I once again find myself spending way too much time both reading and leaving comments. But so what, it was still worthwhile.

Very good article. I certainly appreciate this website. Thanks!

When I originally commented I clicked the -Notify me when new comments are added- checkbox and already each time a comment is added I receive four emails with similar comment. Perhaps there is however you possibly can eliminate me from that service? Thanks!

The following time I read a blog, I hope that it doesnt disappoint me as a lot as this one. I imply, I do know it was my option to learn, however I actually thought youd have something attention-grabbing to say. All I hear is a bunch of whining about something that you possibly can repair for those who werent too busy in search of attention.

Youre so cool! I dont suppose Ive read anything in this way before. So nice to seek out somebody with many original thoughts on this subject. realy i appreciate you for beginning this up. this excellent website is one thing that is needed over the internet, an individual with a bit of originality. beneficial task for bringing new stuff towards the net!

Good article. I’m facing a few of these issues as well..

Your style is really unique compared to other folks I’ve read stuff from. Many thanks for posting when you have the opportunity, Guess I will just bookmark this web site.

Having read this I thought it was rather enlightening. I appreciate you spending some time and effort to put this content together. I once again find myself spending a lot of time both reading and posting comments. But so what, it was still worthwhile!

Pretty! This was a really wonderful article. Many thanks for supplying this information.

Very good information. Lucky me I ran across your blog by accident (stumbleupon). I have saved as a favorite for later.

Hi there! This article could not be written any better! Reading through this article reminds me of my previous roommate! He continually kept preaching about this. I most certainly will send this article to him. Pretty sure he will have a good read. Thanks for sharing!

Excellent blog you have here.. It’s hard to find high-quality writing like yours nowadays. I honestly appreciate individuals like you! Take care!!

After going over a few of the articles on your web site, I really like your technique of blogging. I added it to my bookmark webpage list and will be checking back in the near future. Take a look at my website as well and tell me what you think.

I used to be able to find good info from your articles.

Spot on with this write-up, I seriously believe that this site needs a lot more attention. I’ll probably be returning to read more, thanks for the advice!

Oh my goodness! Impressive article dude! Many thanks, However I am going through troubles with your RSS. I don’t understand why I cannot join it. Is there anybody else having identical RSS issues? Anyone that knows the solution will you kindly respond? Thanks!!

An interesting discussion is worth comment. I do think that you need to write more on this subject, it might not be a taboo matter but typically folks don’t talk about these issues. To the next! Best wishes.

Fantastic post! This is truly insightful for everyone looking to establish a startup. I discovered a lot of actionable advice that I can use in my personal business. Cheers for providing such great information. Looking forward to reading more articles from you! Keep it up! For more tips on startup strategies, check out this great guide: this page.

I’m extremely pleased to find this site. I want to to thank you for ones time due to this wonderful read!! I definitely enjoyed every bit of it and i also have you book-marked to check out new stuff in your web site.

Nice post. I learn something totally new and challenging on sites I stumbleupon everyday. It’s always exciting to read through content from other writers and use a little something from their web sites.

Starting a company can be overwhelming, but with the right resource, you can simplify your launch. This comprehensive guide provides advice on how to establish a successful enterprise and minimize common mistakes. Check out this link for further insights and to discover more about reaching your potential.

This site was… how do you say it? Relevant!! Finally I’ve found something that helped me. Thank you!

Genuinely enjoyed this article. It offered plenty of helpful information. Fantastic effort on writing this.

May I just say what a relief to uncover somebody that actually knows what they are discussing online. You certainly realize how to bring an issue to light and make it important. More people ought to read this and understand this side of the story. I was surprised that you are not more popular since you certainly have the gift.

Besides slots, RedDog lets players meet 100% of the wagering requirements on games like keno and scratch cards, which is uncommon among real money online casinos. That said, bonus funds can’t be used on progressive slots or live dealer games. You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. In 2000, the first Australian federal government passed the Interactive Gambling Moratorium Act, making it illegal for any online casino not licensed and operating before May 2000 to operate. This meant Lasseter’s Online became the only online casino able to operate legally in Australia; however, they cannot take bets from Australian citizens.

https://keeganzaaa853195.blogs100.com/31393698/zar-casino-bonus

The leading PayPal casino sites include BetMGM, Caesars Casino, FanDuel, DraftKings, Bet365, Betway and Unibet. Most licensed online casinos accept PayPal, as they know it is a popular payment method due to the speed, convenience and security it provides. We have ranked the best real money online casinos that accept PayPal in order of their overall quality, with BetMGM and Caesars at the top of the list. Paying with PayPal is quick in easy. It can be done through a website or phone. The most important thing to remember is to check the payment options on the site you are using to make sure it accepts PayPal as a method of payment. If you already use PayPal, then you know how quick and simple the site is to use for online financial transactions. This ease of use also applies to poker PayPal deposits.

Simply wanted to talk about my thoughts with Adam J. Graham’s The Growth Mindset weekly update. If you’re not aware, Adam Graham is the brain behind JustFix, and his newsletter has grown into one of my most valuable guides for staying ahead in technology, entrepreneurship, and startups. I’ve been following it for a while now, and it’s truly one of the best guides I’ve found for both personal and professional development. Check out the full discussion on Reddit here.

devido a esta maravilhosa leitura!!! O que é que eu acho?

This article is wonderful. I learned plenty from going through it. The details is highly informative and arranged.

Having read this I thought it was rather enlightening. I appreciate you finding the time and effort to put this content together. I once again find myself spending a significant amount of time both reading and commenting. But so what, it was still worth it!

Having read this I thought it was rather enlightening. I appreciate you spending some time and energy to put this information together. I once again find myself spending way too much time both reading and posting comments. But so what, it was still worth it.

apreciariam o seu conteúdo. Por favor, me avise.

fortsæt det gode arbejde stipendiater. Med at have så meget indhold og artikler gør du det

Hello, i think that i saw you visited my blog thus i came to “return the favor”.I’m trying to find things to improve my site!I suppose its ok to use a few of your ideas!!

Good article. I will be dealing with many of these issues as well..

I’d like to thank you for the efforts you’ve put in writing this blog. I’m hoping to view the same high-grade blog posts from you in the future as well. In fact, your creative writing abilities has motivated me to get my own, personal blog now 😉

That is a very good tip particularly to those new to the blogosphere. Short but very precise info… Thanks for sharing this one. A must read article!

An intriguing discussion is worth comment. I think that you ought to publish more on this topic, it may not be a taboo subject but typically people do not discuss such subjects. To the next! Cheers.

I was pretty pleased to uncover this page. I need to to thank you for your time due to this fantastic read!! I definitely really liked every little bit of it and i also have you book-marked to check out new things on your web site.

This is extremely educational. I truly appreciated going through it. The content is very arranged and easy to comprehend.

I could not refrain from commenting. Perfectly written.

Great site you have here but I was curious about if you knew of any message boards that cover the same topics discussed here? I’d really love to be a part of online community where I can get feedback from other knowledgeable people that share the same interest. If you have any recommendations, please let me know. Thanks!

Second, Mustang will be out there in two-door hardtop and convertible models with probably the longest listing of options and equipment ever supplied on a new automotive.

One among the largest reasons that Indian jewelry is well-known worldwide is perhaps its unique design and the fact that they’re steeped in tradition.

Today, banks are designing, building, and operating dynamic service models that are more effective and can meet customers’ expectations.

The carmaker released a 2012 version that produced 444 horsepower and reached a speed of 155 mph.

Lay durable ceramic tiles in nation-like checkerboard designs on partitions and floors; embrace Shaker-model peg rails to carry towels and robes; and designate wood cabinet hideaways for on a regular basis toiletries.

Even in case you are ready to invest for the long run, the live stock market definitely will serve your intention to some extent with regard to market statistics.

I really like reading an article that can make people think. Also, many thanks for permitting me to comment.

Retailer its jewellery in a velvet-lined box to keep away from injury.

Pilgrim can get the reward which is equal to the reward of jihad.

Placed in the most sought-after areas of Crete, these lavish villas provide the supreme setting for an memorable escape. Find your perfect escape.

This is the first example of a “structural model”, where bankruptcy is modeled using a microeconomic model of the firm’s capital structure.

Beneath excessive strain and low temperatures, the water in these pipes may form natural-fuel hydrates, strong crystals that may clog up your traces.

Very good information. Lucky me I ran across your site by accident (stumbleupon). I’ve book-marked it for later!

Located in the most desirable areas of Crete, these opulent villas provide the perfect environment for an unforgettable holiday. Find your perfect escape.

I really like looking through an article that will make men and women think. Also, thanks for allowing me to comment.

This is a topic that is close to my heart… Many thanks! Where can I find the contact details for questions?

Geoff Dyer (10 August 2010).

You will need to keep in mind that diagnosing dissociative disorder is a collaborative course of.

Bridal attire: In Bihari weddings, the wedding dress for ladies is a lehenga and is usually in a shiny purple, gold, or yellow shade.

Many valuers are supportive of amalgamation of the NZIV functions under the multi-disciplinary voluntary body PINZ, whilst many others wish to retain a separate statutory professional body for valuers (the NZIV).

You probably have a tiny superstar to have fun, toss together popcorn, peanuts and chocolate-covered raisins for a extra cinematic interpretation.

Many individuals take pleasure in making their own soap.

At the end of the policy period, you are assured of a fabulous return.

Los Angeles Assessment of Books.

And the hotel has paired that tranquility with top-end luxury, from the roomy suites to the lavish amenities to the delectable food.

We can supply related motivational audio system and entertainment, suited to your venue and audience.

Donald Arthur Serjeant Waudby, Observer, No.14 Group, Winchester Royal Observer Corps.

All the opposite colours outside of the wheel are variations of those 12 colors blended with white or black or each other.

The stools slide out of the best way, and the kitchen counter turns into the serving station for a turkey dinner or one thing so simple as crowd-pleasing chips and dips.

But what if you’ll be able to solely go to varsity part-time?

Vårt Land (in Norwegian).

With an amplifier and all these speakers in place, there’s nonetheless one key factor lacking: the crossover.

Nice article this is going to help my chinese mandarin tutoring service!

Going to use this for my SEO agency!

Hey there! I simply wish to give you a huge thumbs up for your excellent info you have here on this post. I am returning to your web site for more soon.

Also to ensure that you have all the right qualifications and education to be a certified financial analyst and that your certificate holds weight in the real world, for this, the quality of your school is extremely vital.

A good place to sort out all the different labels is Consumer Reports’ GreenerChoices Web site.

One such firm can manage several private equity funds.

Marv & Tarry Everingham Sheridan, Michigan family of Charles Everingham of Onaway.

Thsi will help with my chinese online tutoring lessons.

Thsi will help with my Google Entity Stacking service.

I was able to find good advice from your content.

Thsi will help with my Google Entity Stacking service.

Thsi will help with my Google Entity Stacking service.

Thsi will help with my Google Entity Stacking service.

Thsi will help with my Estrogen Blocker Supplements!

Thsi will help with my Estrogen Blocker Supplements!

The city has completely different names in local Native languages.

Thsi will help with my Estrogen Blocker Supplements!

Thsi will help with my Estrogen Blocker Supplements!

Hi! I just wish to give you a big thumbs up for your excellent info you’ve got here on this post. I will be returning to your website for more soon.

During requirements analysis, performance (how well does it have to be done) requirements will be interactively developed across all identified functions based on system life cycle factors; and characterized in terms of the degree of certainty in their estimate, the degree of criticality to the system success, and their relationship to other requirements.

Thsi will help with my Estrogen Blocker Supplements!

thanks for this article!

thanks for this article!

thanks for this article!

Even people who didn’t make it had a few moments of love, of understanding that people is usually a constructive part of their spirit.

Apart from the most seasoned, adventurous, analysis-loving traveler, specialized, thematic tours might be completely price the money.

Owing to the despotic rule of Cambyses and his lengthy absence in Egypt, “the entire people, Persians, Medes and all the other nations” acknowledged the usurper, particularly as he granted a remission of taxes for three years (Herodotus iii.

I could not reveal him anything and I had not stored my friend cell number in my diary to dial up from my father’s cell phone.

They are way more cautious about being diversified.

There are situations when the only provides you will need to spend money on are the chocolates or candies.

thanks for this article!

thanks for this article!

This is the right site for anybody who really wants to understand this topic. You realize so much its almost tough to argue with you (not that I personally will need to…HaHa). You definitely put a brand new spin on a topic that’s been written about for ages. Great stuff, just wonderful.

For those loves local dishes, Greek Crete affords a culinary journey with authentic Greek-style meals. Relish seafood specialties, extra virgin olive oil, and aromatic herbs that define the local cuisine. Read more

thanks for this article!

Hi, What is the best free software to automatically backup wordpress database and files ? A software that is trustworthy and would not hack your password in wordpress. Have you tried it ? For How long ? Thanks……

thanks for this article!

Pretty! This was a really wonderful article. Thank you for providing these details.

thanks for this article!

39/2008 on State Ministries mandated that a ministry must have specific function and responsibilities and also must have minimum number of directorates and other ministerial apparatuses, thus formation of minister without portfolio is currently unlikely in post-Reformation Indonesia.

Certified banks borrow from one another inside this band, but never above or below, because the central bank will at all times lend to them at the top of the band, and take deposits at the bottom of the band; in precept, the capability to borrow and lend on the extremes of the band are unlimited.

For example, individuals who earn $70,000 will pay solely 30 on the quantity that falls between $48,001 and $70,000 moderately than paying on the total $70,000.

Installing the mistaken kind may cause points like corrupt files, which could cripple your system, so ensure to learn your proprietor’s guide or go to your laptop producer’s site to determine what sort of RAM you want in your mannequin.

After the National Socialists rise to power in Germany, she emigrated to the United States in March 1939.

Before 1972, Pussade and Posade Forsthaus belonged to the municipality of Harlingen, Dötzingen Manor, Hagen Manor, Marwedel, Meudelfitz Manor, Meudelfitz and Sarchem to the city of Hitzacker and Leitstade to Wietzetze.

I needed to thank you for this fantastic read!! I definitely loved every little bit of it. I’ve got you saved as a favorite to check out new things you post…

It is the financial contract futures that allow an investor to hedge with or speculate on the future value of various components of the NASDAQ market index.

The idea for the slogan was born out of an advertising meeting.

It is extra explicit with large scale organizations which have a number of branches across the globe.

“synthroid generic canada“

Aw, this was an incredibly nice post. Taking the time and actual effort to produce a really good article… but what can I say… I hesitate a whole lot and never seem to get nearly anything done.

Hi! I just wish to give you a huge thumbs up for your great information you have right here on this post. I am returning to your website for more soon.

The only difference between this aircraft and the cargo version is the specialised, highly delicate weather gear installed on the WC-130.

Throughout this time their two daughters have been born, Marie in 1975 and Sophia in 1977.

Land – It is possible since 2007 to purchase actual property on the exchanges by actual estate investment trusts (REITs) in the UK, though the nature of the funding nearly qualifies it as a traditional versus different investment.

Good article. I definitely love this website. Keep it up!

You need to wait for an extended period of time and watch till the inventory reaches a higher worth.

Graft, Kris (September 18, 2014).

Credit companies realized they could make more money in interest payments by extending higher-interest lines of credit to consumers who carried debt from month to month — the people most likely to default.

It is really important for you to pay extra attention in selecting a stock to acquire.

May I just say what a comfort to discover someone that really understands what they’re discussing over the internet. You actually understand how to bring an issue to light and make it important. A lot more people must check this out and understand this side of your story. I was surprised you aren’t more popular since you most certainly have the gift.

Oh my goodness! Incredible article dude! Many thanks, However I am encountering difficulties with your RSS. I don’t understand the reason why I am unable to subscribe to it. Is there anybody getting the same RSS issues? Anyone that knows the solution can you kindly respond? Thanx.

This constructing, of which the nave was not accomplished till the thirties, could be very much larger than St Andrew’s and has three large rose windows and an unlimited East window, the tracery of which was primarily based immediately on that of Lincoln Cathedral, c.1280.

Commonplace was the “Hurricane,” Jeep’s dated four-cylinder F-Head engine, which was running out of wind by 1967 and put out just seventy five horsepower from 134 cubic inches.

Mayer’s mother and father died when she was in her early teenagers and her uncle, a authorized guardian after the passing of her parents, died only a few years later.

Beside gold, a lot of these chains are manufactured from silver and platinum in keeping with the shoppers demand and choice.

Fusion Event Staffing. “Know How.” 2009.

PTypes Personality Types. 2010.

Cohen and his team of penny stock experts does the all the difficult behind-the-scenes work for you to produce one of the most impressive penny stock investment recommendation lists on the market today.

The longer the availability chains are the more fragile and fewer resilient they are in crisis.

Everything is very open with a really clear explanation of the issues. It was definitely informative. Your site is useful. Many thanks for sharing!

Your style is very unique compared to other people I have read stuff from. Thank you for posting when you have the opportunity, Guess I’ll just bookmark this blog.

There is certainly a great deal to learn about this issue. I love all the points you’ve made.

gruppe? Der er mange mennesker, som jeg tror virkelig ville

Hi, I think your website might be having web browser compatibility issues. Whenever I look at your web site in Safari, it looks fine however, if opening in Internet Explorer, it’s got some overlapping issues. I just wanted to give you a quick heads up! Besides that, fantastic site!

Oh my goodness! Impressive article dude! Many thanks, However I am going through problems with your RSS. I don’t know the reason why I am unable to subscribe to it. Is there anybody having the same RSS issues? Anyone that knows the answer can you kindly respond? Thanks.

že spousta z něj se objevuje na internetu bez mého souhlasu.

nogensinde løbe ind i problemer med plagorisme eller krænkelse af ophavsretten? Mit websted har en masse unikt indhold, jeg har

Greetings! Very helpful advice within this post! It’s the little changes that make the greatest changes. Thanks a lot for sharing!

I was able to find good advice from your blog posts.

The pharmaceutical lobby needs stricter intellectual property legal guidelines to protect its patents.

How are lawsuit settlements taxed?

That is not to say it is inconceivable to discover a one-star hotel in center-of-nowhere America, but when you are off the overwhelmed path, you may doubtless come across more motels than motels on your journey.

On poster board, draw two massive elephant ears and lower them out.

If you’re successful at reviving your dog, they need to go to the veterinarian instantly.

Great article! I learned a lot from your detailed explanation. Looking forward to more informative content like this!

Eight p.c of school members have owned a enterprise.

All of these storage items are available in small, medium, giant and extra massive sizes.

17. Most technical marketplace indicators are of small value.

The Weatherford Resort and Orpheum Theater are still in use at this time.

As of August 2021, it had assets exceeding KSh 1.119 Trillion (US$10.1 billion).

This can make an enormous difference in what kind of lunch you set collectively.

However what happens when she meets a handsome man who turns into her drinking buddy for the evening?

Since a single hospital keep may wipe out your financial savings (and more), not many people can afford to go with out some type of health insurance — even if they’re healthy.

Policies that expanded telehealth services during the pandemic have increased access to mental health care.

As a result, Malkiel argued, stock prices are best described by a statistical process called a “random walk” meaning each day’s deviations from the central value are random and unpredictable.

A member of the Wheatridge Grange.

From the BBC we learn that “Fergus Bell has left Torquay United resulting from being on an ‘unsustainable deal’, says Gulls participant-boss Kevin Nicholson. The 24-yr-previous ex-Mansfield midfielder joined the Nationwide League strugglers on non-contract terms final month and made six appearances in all. ‘He was dropping cash every day simply turning up, and that is no method to dwell for anyone’, Nicholson instructed BBC Devon. ‘He’s gone off to train, earn something a bit more secure and a bit extra permanent and I do not blame him. His attitude was bang on, but the deal that Fergus was on was unsustainable for him and that i wasn’t ready where I may give him anything better’. He also confirmed that on-mortgage Harry Hickford will return to guardian club MK Dons after Saturday’s match against Grimsby”.

You’ll be less likely to overspend if you realize how much money has actually gone through your hands.