By now, the majority of us are well aware about the CMA US course which confers a prestigious global professional credential in the field of management accounting. The question often arises: why should one pursue this course? If you are a commerce graduate and a job seeker, you might know that a mere graduation nowadays will not be enough to get a decent job.

So, you need additional professional qualifications. In doing so, you will definitely consider the options and compare in terms of the duration, cost and pass rate of such courses. Here, US CMA comes on top of others that you can achieve at one go. On the other hand, if you are a working accounting professional, you might be aware of the fact that repetitive accounting jobs are being increasingly threatened by automation through the advent of artificial intelligence (AI). So, what should you do to make your job “future-proof? The answer is go for US CMA.

Give your resume a career-enhancing boost with a CMA US certification. If you are working in the financial, accounting, or business industry, this certification can boost your profile resulting in higher pay, more benefits, and better job opportunities. You will be at the top of the hiring list of many companies.

Still, if you would think that you are already done or are doing a degree course in finance, accounts, or business, why would you need another certification? The truth is that in a CMA US certification course, you learn many things that are not usually taught in degree courses. Industry trends keep changing and for a degree to get updated accordingly takes time. US CMA certifications have this advantage.

They are all updated to be in-tune with the latest happenings. Therefore, a CMA US certification will have all the latest updates regarding accounts, business and finance. And this is what puts you at an advantage over other candidates when you are applying for your dream job. Let’s look at some other advantages of having a CMA US certification.

1. Business Appeal

The main benefit of US CMA certification is that it is considered to be the best accounting certification for management as it has the perfect amalgamation of business and accounting. In CMA US, you learn all about corporate governance and other important business aspects, finance, and accounting concepts, including responsible accounting. Therefore, candidates with CMA US certification are allowed to take business decisions or are involved in collective business decisions.

Companies trust their business acumen and they are handed important roles in an organization. This certification makes candidates learn the difference between conventional accounting and accounting that is profitable and efficient. Therefore, if you get a CMA US certification, you will have better business appeal.

2. Growth Opportunities

US CMA is a management-level certification which brings multiple growth opportunities. When compared to college graduates without any additional certification, it was found that US CMA candidates get better entry-level jobs, and opportunities to get promoted.

The CMA US certificate is a beacon that signals you are not just going to do accounting; you are going to take on more responsibilities and manage the accounts. Other candidates also do not grow beyond a certain position and salary, while with a CMA certification, you can quickly move into a management position.

3. More Money

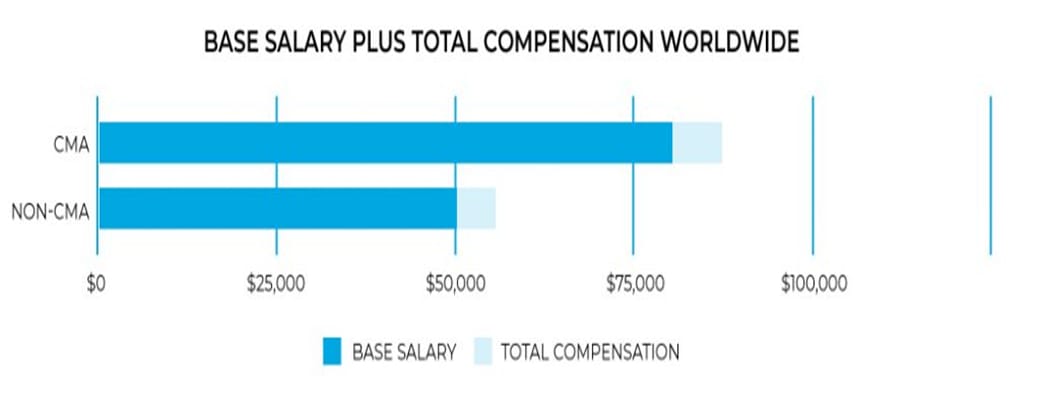

Money is the biggest motivating factor for most professionals, so why not you? Getting a CMA US certification makes you eligible for a higher salary than other candidates. In recent studies, it was found that CMA US certification holders earn up to 67% more than other candidates having just a degree.

When benefits like health insurance, pension, and fringe benefits are measured, the earning potential is even more. This is because US CMA certified candidates move up into management faster after gaining experience, and even when they switch jobs, they get a bigger raise as CMA US certified candidates are high in demand in the job market.

Basic Accounting Knowledge Required for a Smooth US CMA Journey:– If you are serious about the CMA with no accounting experience, or get detached from your study for a prolonged period then you should start by getting up to speed with accounting basics. The idea is to get familiar with basic accounting concepts and principles…. Continue reading

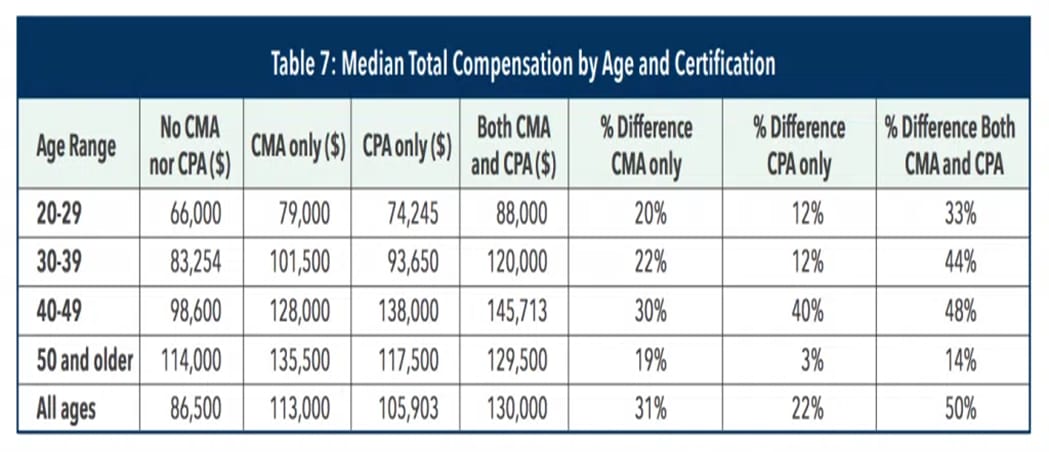

According to the 2019 IMA’s CMA Salary Survey, US CMAs earn 31% higher median total compensation than individuals without the CMA designation. The average US CMA (of any age) earns $113,000 annually in total compensation.

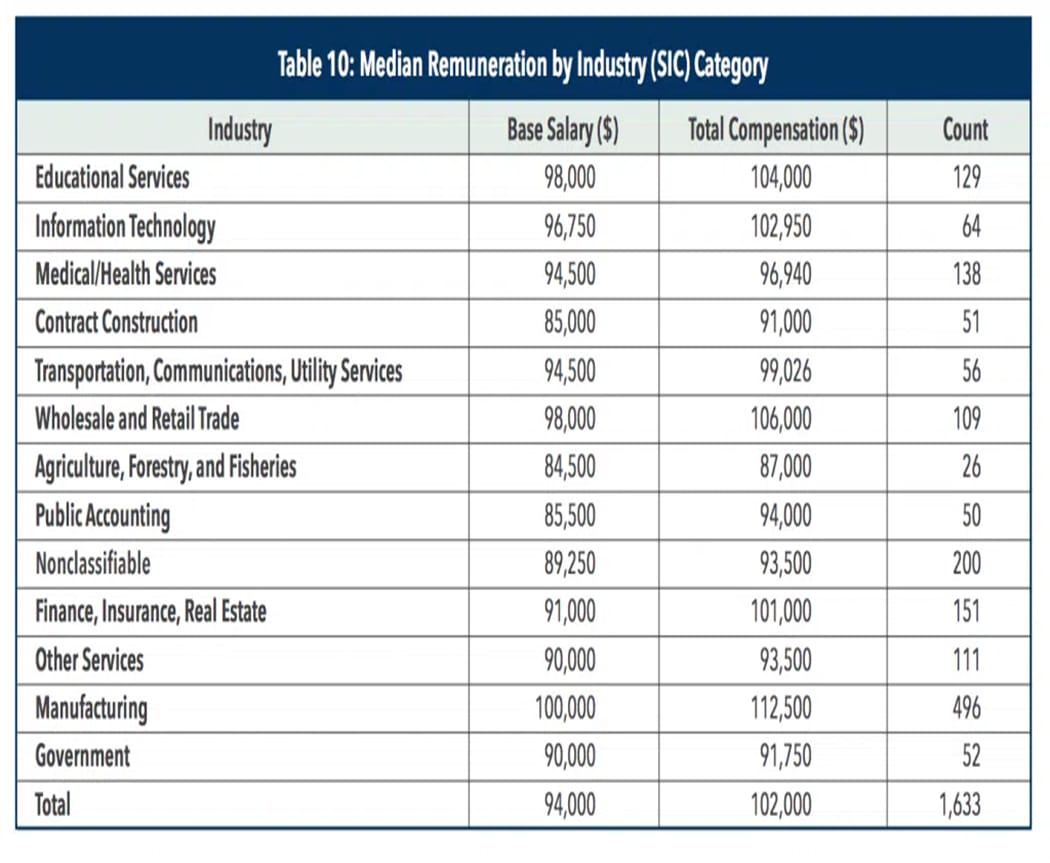

For example, the highest median total compensation for a CMA is in the manufacturing industry, where they earn a whopping $112,000. In comparison, the median total compensation for a CMA in a government position is $91,750. While both salaries are more than acceptable, it’s nice to know your options.

Below is a full breakdown of salary by industry for your perusing pleasure:

US CMA Salary

| Management Level | Median Base Salary |

| Top | 150,000 |

| Senior | 134,071 |

| Middle | 100,000 |

| Lower | 73,717 |

| All Levels | 105,000 |

Plan for US CMA course in 2022- Jobs & Salary |Eligibility| Course fees |Syllabus| Duration | By Uplift Professionals :- US CMA is in great demand in all sectors. CMAs are also being recruited by MNCs like Accenture, Amazon, and Deloitte and so on for the managerial positions like financial controllers, Budget Analysts, Cost Auditors, Chief financial controller and many other high level positions…. continue reading

4. Global Opportunities

US CMA certification has value on a global level. You may be a graduate and get a good job in your country, but if you have dreams of working abroad in another country, you will have to get CMA US certification. Some countries may not give much value to your college degree, depending upon which country you have studied in and which country you want to work in. However, CMA US certification is recognized and valued the world over, and you can easily apply for a job in the Western, European, and Middle Eastern countries, where the salary scales are much higher.

5. Value as an Employee

US CMA trains you to have a better understanding of business, finance, and accounts. So, you don’t merely do a task, you understand the reason behind it and you find ways of doing it efficiently to provide a better result than expected. You will become the go-to person for important questions. Your opinion will be valued, and you will soon become an integral part of the management. Many US CMA certified candidates have also gone on to become CFOs. Therefore, with CMA US certification, you will be valued more as an employee, and will always get your due appreciation.

The CMA US empowers many accountants to move up to bigger and better things. According to the IMA, these are a few positions held by CMAs:

| Staff Accountant | Cost Accountant | Senior Accountant | Controller |

| Budget Analyst | Internal Auditor | Finance Manager | Financial Analyst |

| Chief Financial Officer | Chief Executive Officer | Vice President, Finance | Treasurer |

Here is a look at some of the most exciting CMA jobs globally:

Management Accountant

If you thrive on planning and strategizing, then management accounting could be an exciting career path for you. As a management accountant, you are responsible for budgeting, planning, and strategizing so that your company’s top managers and executives can focus on risk-assessed decisions about their financial future. This position requires you to be an expert in accounting with high-level communication skills. You can find management accountants in private or public businesses or within government agencies.

Financial Analyst

Do the microeconomic aspects of finance thrill you? If so, becoming a financial analyst may be right for you. For starters, financial analysts can work in many industries, including a bank or an insurance company, or even a startup or global enterprise. This role requires careful attention to detail so the analyst can assess the financial condition of a potential investment to make sure it is worthwhile.

Other daily job duties include advising businesses on how to issue corporate bonds or split stock, as well as perform financial research and analysis to provide information on the business’s profitability, stability, liquidity, and solvency.

Cost Accountant

Cost accountants are responsible for recording and analyzing each cost incurred by a business. In turn, they use this information to identify where the company is losing money unnecessarily and how to improve their financial management. Typical job duties include preparing asset, liability, and capital account entries, documenting financial transactions, making financial recommendations based on the analysis of financial history. This role is highly valued across several business models, so you could find yourself working in the retail sector, consulting firms, or directly within a business or corporation.

Accounting Manager

Accounting Managers develop and maintain accounting systems and procedures used by other accountants to collect and analyze data. Some standard job duties for an accounting manager include overseeing daily operations, monitoring and analyzing data, creating financial statements and reports, as well as upholding strict accounting policies and principles. In this role, you will oversee other accountants and would most likely work for a large company or organization where there are multiple accountants employed.

Senior Accountant

Senior accountants are more managerial than junior accountants, and tend not to perform administrative tasks. Instead, senior accountants are responsible for reporting cost margins, productivity, and expenditures within a company. Your average day of work may include preparing month-end procedures, reconciling accountant balances, and maintaining a general ledger. Senior accountants often mentor junior staff as well and will likely be expected to lead accounting initiatives with other accounting teams and departments.

Corporate Controller

Corporate controllers oversee a company’s financial and accounting functions, including everything from billing, accounts payable, accounts receivable, and budgeting. Job duties include preparing the annual budget, preparing internal and external financial statements, assessing current accounting operations, as well as coordinating activities for external auditors.

Corporate controllers often oversee other accountants, so the skills and knowledge learned from earning your CMA is invaluable. While the expertise of a controller can be utilized in any business, it is larger companies and organizations that tend to attract this position more.

Chief Financial Officer (CFO)

A Chief Financial Officer is one of the top positions you can rise to as a CMA in business. Becoming a CFO gets you a high-level executive role and the compensation to match. CFOs are largely considered the right hand to CEOs because they oversee everything from financial reporting and forecasting to a company’s investments and financial business decisions.

Some of the most critical job duties performed by a CFO include tracking cash flow, analyzing their financial strengths and weaknesses, and proposing corrective actions. You will need years of experience to develop the unique skills required to become a Chief Financial Officer, but earning your US CMA will definitely put you on the right path.

Landing a job with one of the Big Four is a career goal of many, so how can the CMA designation help you secure a future with one of them?

The Big Four are constantly on the hunt for accounting professionals who can demonstrate the qualities needed to fulfill roles such as:

- Risk Management Advisory Manager Accounting & Reporting Transformation Senior Consultant

- Government & Public Sector Strategy Manager

- Risk Assurance Advisor (Manager)

- Risk Transformation Advisory Senior Manager

The reality is all of these roles are perfect for the unique skills learned as a CMA professional.

Why Become a CMA? -What Top Professionals Says

- “I decided to go after my CMA because I felt that the CPA left some gap in the trade skills that I needed to have to continue my career in industry,” says Ben Mulling, CFO of TENTE Casters, Inc., in Hebron, Ky. Mulling is a member of IMA’s Global Board of Directors and also holds the Certified Public Accountant (CPA) and Certified Information Technology Professional (CITP) designations.

- Mulling says the CMA credential has “tremendously” helped him in his career. “It provided me with critical decision-support skills that I have used to advance my career to CFO of my company,” he says. Even with his CPA license, he says he could not have succeeded in guiding his company through the recession and back into growth mode without the skills he mastered as a CMA US.

- Lon Searle, CFO of YESCO Franchising LLC in Salt Lake City, Utah, said he decided to become a CMA because he knew he would be promoted to CFO someday and he wanted to be prepared to be a world-class financial leader. Searle says the CMA US certification provides a very large advantage in the job market. There are jobs that require either a CPA or CMA designation, he says. CMAs are exceptional when it comes to supervising teams, managing projects, and making high-level business decisions.

- Steve Kuchen, a member of the IMA’s Small Business Financial and Regulatory Affairs Committee, says, “After leaving a job, I went to a search firm specializing in finance and accounting professionals and the recruiter really impressed upon me how important it was to have some credentials after my name. He thought that the CMA would be just right based on my prior experiences and interests.”

- Kuchen says attaining the CMA US shows that you are serious about your career and interested in improving your skill set. He also says the US CMA material is very relevant to real-world situations you might encounter, not only in finance and accounting but also in other disciplines like information technology.

Summary

If you are contemplating getting CMA US certification, stop contemplating and go for it. It is going to have a huge impact on your career, and you will be glad that you have done the certification. Your dream job will be yours much quicker, and you will reach the pinnacle of your career. Enroll for a CMA US certification today! You can also go for degree courses simultaneously. Becoming a CMA US involves a commitment of money and, most of all, time that shouldn’t be taken lightly.

But if you want to pursue a career as a management accountant, the extra effort can pay off. Clearly, becoming a CMA US helps your career in many ways, and taking the US CMA exam is an important step toward achieving that status. Consequently, choosing the right US CMA exam prep is an important step toward passing the CMA US exam. Uplift-Gleim CMA prep is one of the fine-tuned systems which can tremendously help you to pass the US CMA exam at first attempt.

For Further Information/Assistance, Contact: