When we talk about the Certified Public Accountant (CPA) credential, we often discuss the repute and potential of this coveted accounting certification. We also know about the pattern and syllabus of this exam and licensing procedures obviously if we are serious about the CPA title. But, are we aware of the CPA Evolution initiative? Are we aware that the Unified CPA Exam is changing significantly in January 2024? Before jumping in to the bandwagon, it is important to know about this initiative and the upcoming changes to the CPA Exam to fully understand how it might impact the sojourn to CPA licensure. The question often comes to mind whether it is applicable to the current CPA pursuant or not? The answer to this stands as if you pass and retain credit for all four CPA Exam sections by December 31, 2023, the changes to the CPA Exam will NOT impact your journey. If you will still be working your way through the CPA Exam in January 2024 and beyond then the information about the CPA Evolution-aligned CPA Exam (the 2024 CPA Exam) and transition policy are most important to understand.

The Present CPA Exam Areas – the 4 Core Sections

The 4 Sections which a CPA aspirant has to clear through separate exams for each section is mentioned below.

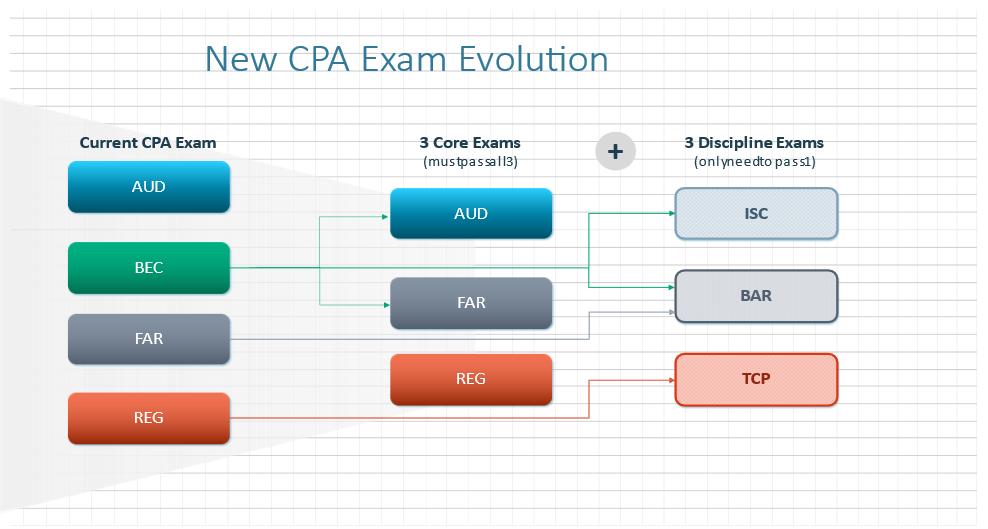

Metamorphosis: The Proposed Forthcoming Areas of CPA Exam

According to the proposed initiative, the following structural plan for the CPA exam will be implemented from January, 2023.

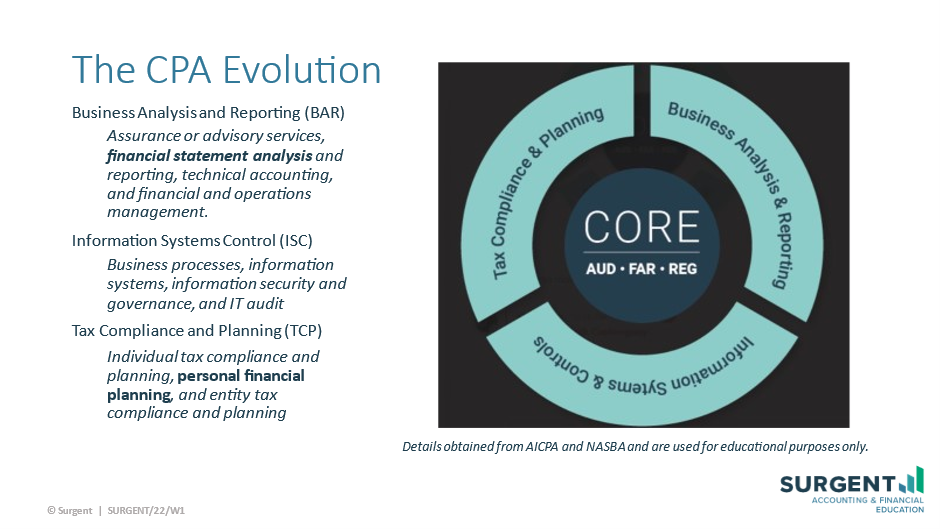

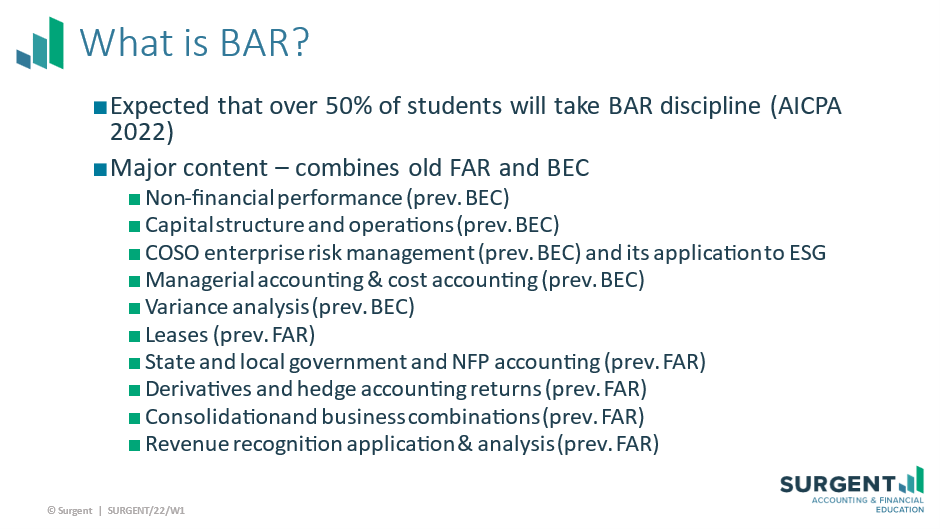

The new CPA licensure and CPA Exam model is a Core + Discipline model. In this model, there are 3 core areas involve accounting, auditing, and tax that are mandatory to complete by all candidates. Furthermore, each candidate must opt for a Discipline section for demonstration of greater skills and knowledge. Technology knowledge and skills will be tested in all sections, as it pertains to each section. Irrespective of a candidate’s optional discipline, this model leads to a full CPA license, with rights and privileges consistent with any other CPA. The Discipline section selected for testing does not mean the CPA is limited to that practice area. The new Disciplines reflect three pillars of the CPA profession as mentioned below.

- Business Analysis and Reporting (BAR)

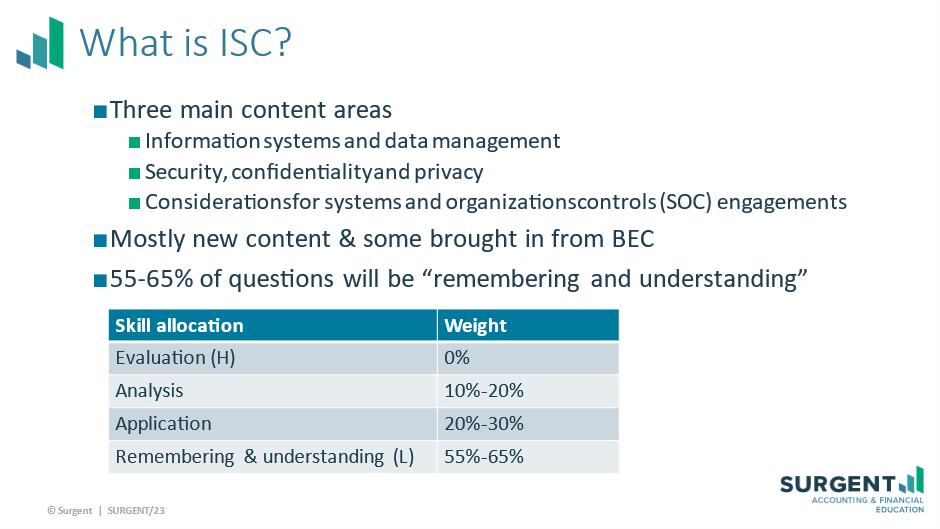

- Information Systems and Controls (ISC)

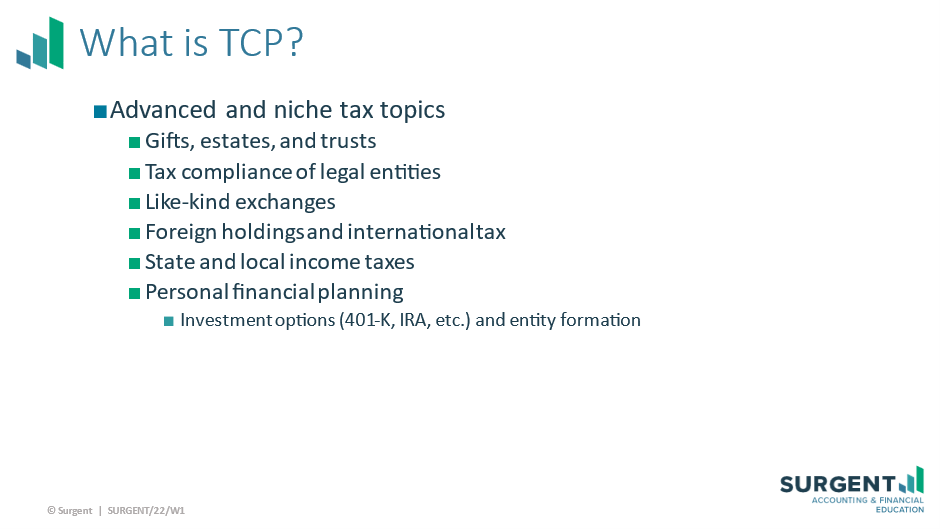

- Tax Compliance and Planning (TCP)

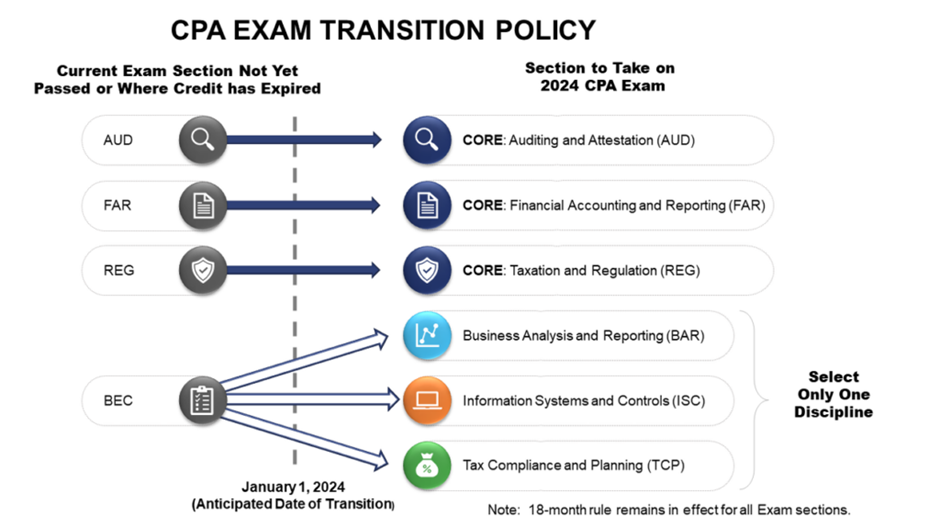

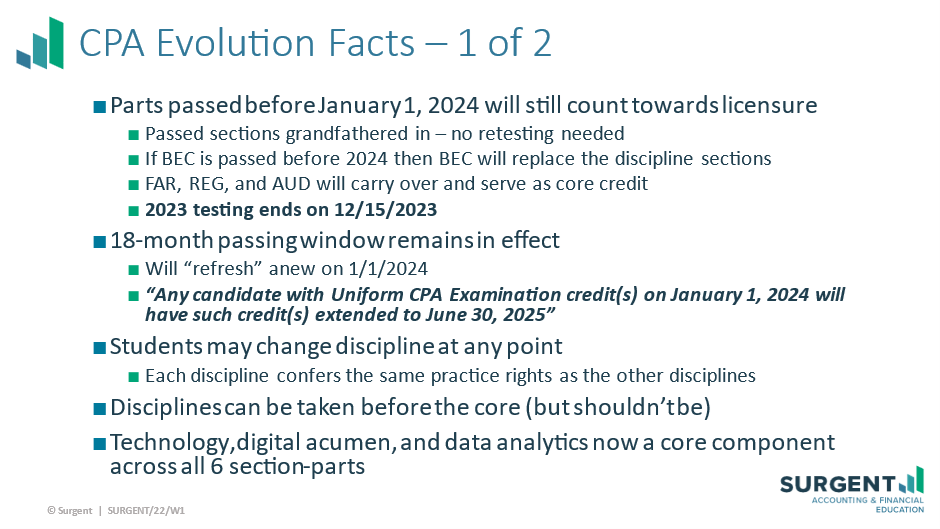

CPA Evolution: The Transition Policy for Each Section

The transition policy was recommended to the Boards of Accountancy by the NASBA CBT Administration Committee which states that Candidates who have credit for AUD, FAR or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam. Candidates who have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections. If, however, a candidate loses credit for AUD, FAR or REG after December 31, 2023, they then must take the corresponding new Core section of AUD, FAR or REG. A candidate who loses credit for BEC after December 31, 2023, must select one of the three Discipline sections to be tested. It is important to note that none of the sections of the current CPA Exam will be available for testing after December 31, 2023. There is a hard cutover from the current CPA Exam sections to the 2024 CPA Exam sections on the January 2024 launch.

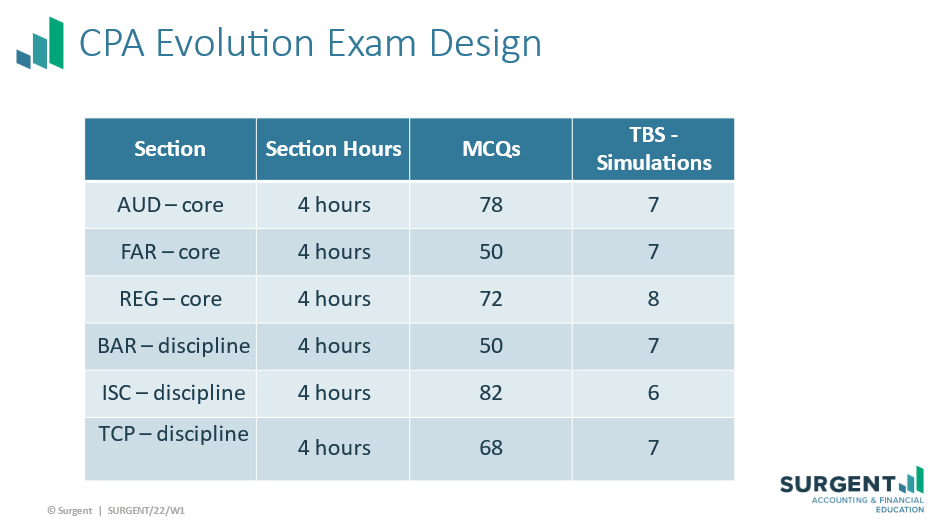

Break-up of the New CPA Evolution Exam Design

The forthcoming changes in the new CPA exam pattern is depicted below for convenience. The duration is fixed while the number of MCQs and Task Based simulations(TBS) vary.

Key Facts on CPA Evolution Exam Pattern

The important points to remember about the changing pattern and implications are mentioned below.

The Credit Extension of New CPA Evolution Exam

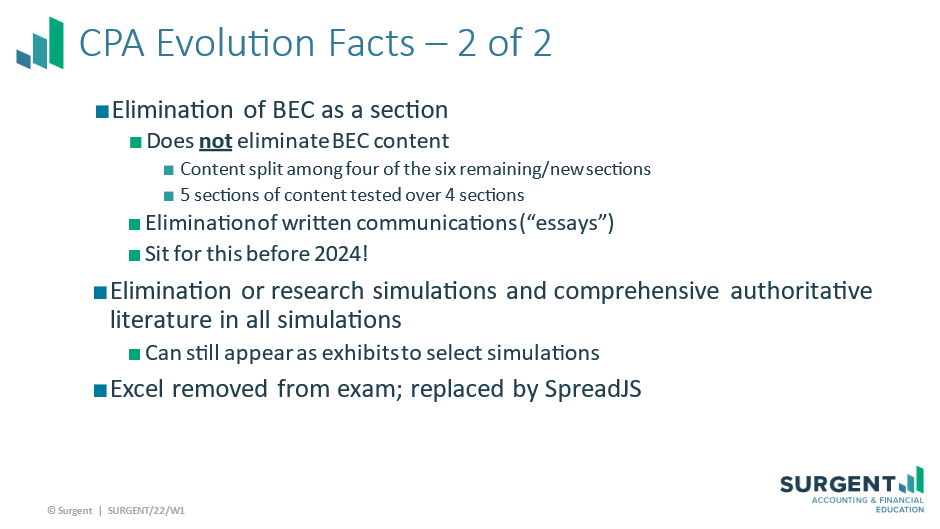

CPA Evolution Exam Section wise Changes

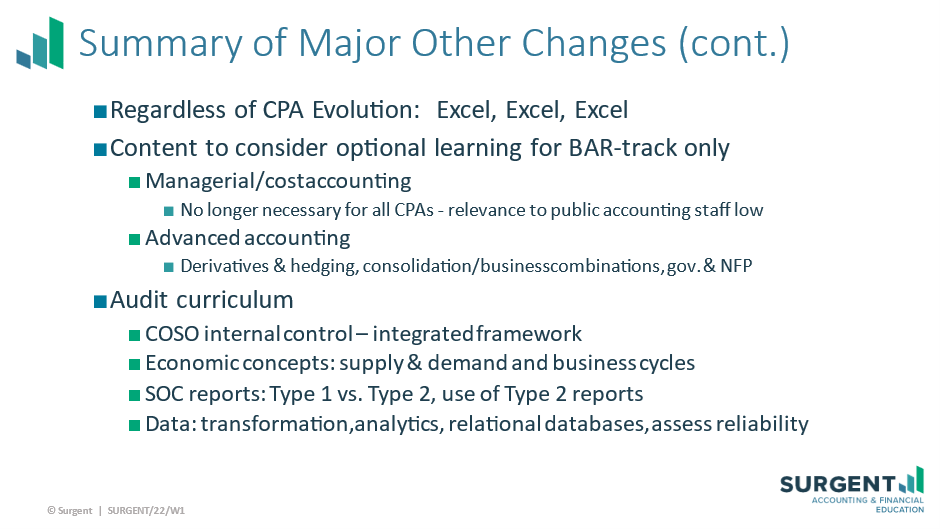

There are additions/modifications of contents in the new CPA exam sections which one must get accustomed to before starting the CPA journey in the coming year. Salient features of the changes are depicted below.

Some Other Changes for Newly Revolutionized CPA

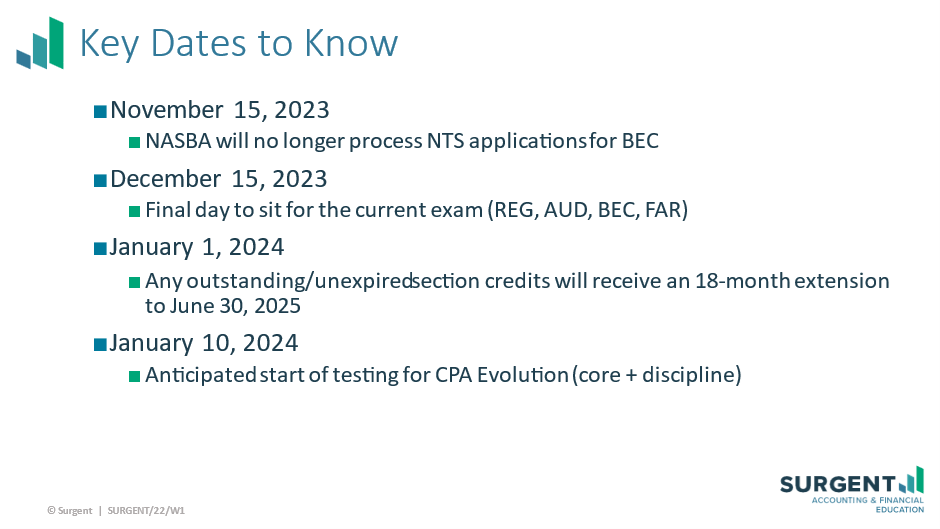

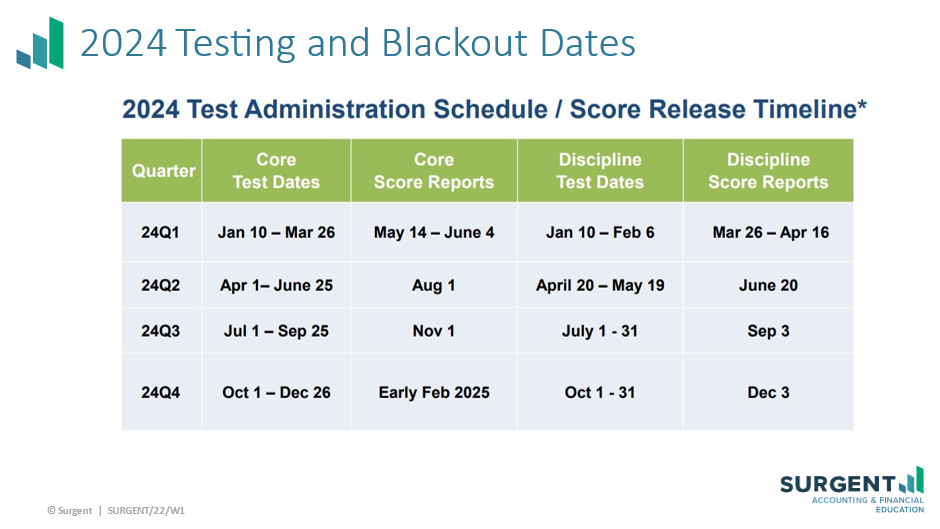

CPA Evolution Dates to Remember

Summary

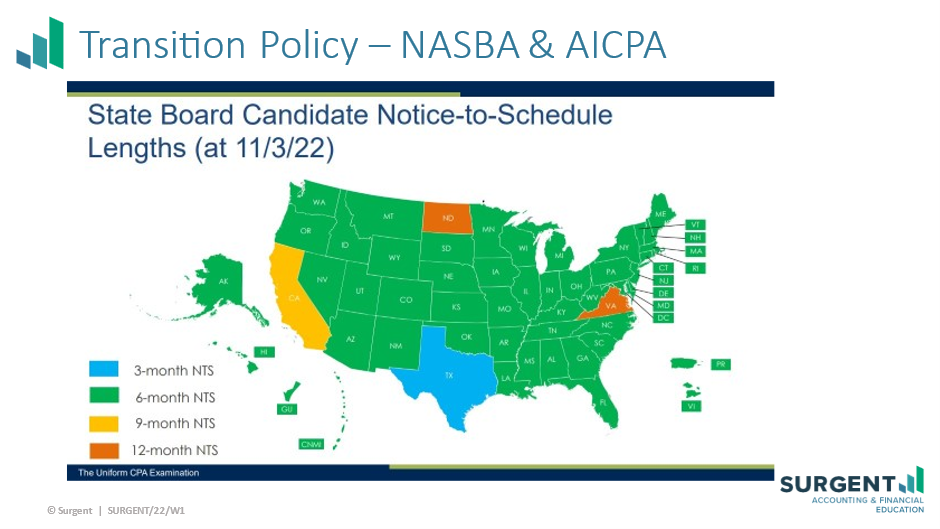

The amalgamation of new interdisciplinary domains in this CPA evolution will make a CPA more compatible in the new age financial arena. It has never been a more exciting time to pursue the CPA license. The role of today’s CPA has evolved, and newly licensed CPAs are taking on increased responsibilities that were traditionally assigned to more experienced staff. Becoming a CPA means you will need greater skill sets and competencies, and a greater knowledge of emerging technologies. That is why the CPA Evolution initiative is underway. It is a joint effort of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA).

For Further Information/Assistance, Contact: